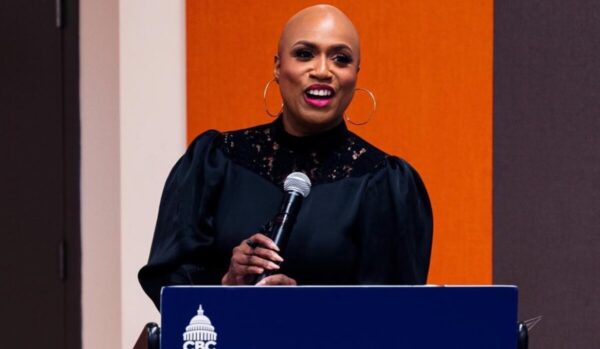

Congresswoman Ayanna Pressley is demanding an update on the multi-billion pledges that five of the nation’s biggest banks made during the 2020 summer of civil unrest.

On Wednesday, Aug. 23, the Massachusetts Democrat sent letters to the CEOs of JPMorgan Chase, Citigroup, Bank of America, U.S. Bancorp, and Wells Fargo, asking each to provide a “comprehensive financial audit report” by Oct. 23 about their promises that collectively amounted to over $32 billion.

Prompted by demands laid out by Black Lives Matter activists and other civil justice workers, the five major banks pledged to not only funnel money into housing programs and small business lending but to dissolve lending practices that have traditionally been racially biased or discriminatory. They also pledged to invest in diversity and inclusion initiatives.

The largest of the pledges came from JP Morgan Chase. Over the course of five years, the banking institution said it would invest $30 billion into those efforts.

Executives for the bank said in February 2022 that the company had already deployed or allocated $13 billion of the pledge to finance 60,000 affordable housing and rental units. It also said it had approved $1 billion for affordable homes.

In the year of George Floyd’s death, which brought national attention to systemic and institutional racism, Citibank and Bank of America initially committed $1 billion each.

USBancorp’s US Bank allocated $116 million in June 2020 to tackle racial and economic disparities.

In March 2021, Bank of America later increased its pledge to $1.25 billion.

By September 2022, Wells Fargo announced a $420 million fund for diverse small-business owners as part of a racial equity audit.

The anticipated audit will encompass data, plans, and policy adjustments pertaining to the commitments undertaken by each institution.

“Whether you’re talking about redlining or denying credit for Black homebuyers and entrepreneurs, or closing brick-and-mortar banks in Black communities, Black folks have historically been denied opportunities to grow wealth, to achieve financial prosperity,” Pressley told NBC News.

“The harm was very precise,” the representative added. “The work of restorative justice, of racial justice, of justice for Black Americans, has to be just as precise.”

Like the banks, during the Floyd and Breonna Taylor protests, many businesses committed to racial equality initiatives. The congresswoman’s effort is to hold, at least the banks, to their word.

Many celebrated her effort.

“Time to pay the toll, banks!” one person tweeted.

“Show the receipts,” a Twitter user demanded.

“We need more of this from Congress. Thank you Rep. @AyannaPressley!” one comment read.

While another joked, “Run me my money.”

One comment believed the move was performative and was less about calling the banks out and informing others of what the banks had promised.

“If I may say Rep. Pressley is nobody’s fool,” another person wrote. “She knows the banks are powerful and can do as they please. I do not think she will miss a beat when they continue with their bulls##t. She’s just letting you know who she is and what they are.”

Pressley, who sits on the House Financial Services Committee, added, “I’m not going into this with contingency plans. You have to first just lay it out there.”

The lawmaker said she also thinks the banks “will be responsive.”

“They want to be on the right side of history,” she added.