American families can look forward to monthly financial relief, now that the enhanced child tax credit 2021 is set to start disbursing advance payments on July 15.

This enhanced child tax credit is an expansion of President Joe Biden’s American Rescue Plan. This includes a $1.9 trillion stimulus package that the president signed into law in March.

The expansion boosts the credit to $3600 per child under 6 years of age and $3000 for children aged 6-17.

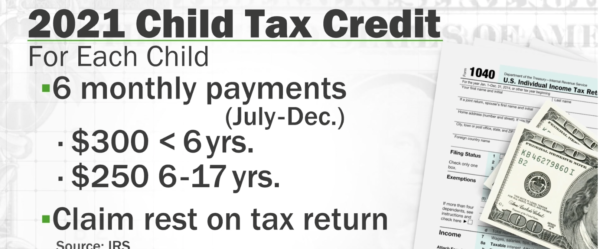

Monthly disbursements will continue for eligible families across the country for the next six months, according to the Internal Revenue Service.

Recent changes to the child tax credit mean more than 30 million households will begin receiving monthly payment this July without any further action. That translates monthly to eligible families receiving payments of up to $300 for each child younger than 6 and up to $250 dollars for each qualifying child from 6 to 17.

WHAT MAKES YOUR FAMILY ELIGIBLE?

The enhanced child tax credit has an income phase-out for single taxpayers at $75,000. For an individual filing as head of household, the phase-out is $112,000, and $150,000 for those married and filing jointly. Once the above income thresholds are reached, the credit is reduced by $50 per $1,000 or fraction of every $1,000 past the threshold. A patent filing an individual return with an adjusted gross income of $80,000 would see the credit reduced by $250. These reductions only apply to the enhanced part of the credit, which is an extra $1,600 this year after the child tax credit was increased from 2020 levels.

Families should begin to see payments hit their accounts two to three days after the IRS disbursements on the 15th of every month through the end of the year. Paper checks will be mailed out according to the same timeline.

The monthly payments only amount to half of an eligible parent’s credit. The remainder can be claimed when filing 2021 taxes next year.

Families also have the option to opt out of the advance credit. This option would allow for a large lump sum to spend at once instead of the smaller monthly payments.

The IRS also warns to beware of scams during the rollout of the child tax credit program.

“With the advanced payments of the child tax credit going out to eligible taxpayers, the IRS warns folks to be aware that thieves may use these payments as bait. Be alert to criminals who ask you, by phone, email, text — or even on social media, to verify your information so you can get the advance child tax credit payments. Remember, the IRS does not initiate contact with taxpayers by email, text messages, or social media channels to request personal or financial information,” says the IRS.

If you suspect that you’ve been scammed visit IRS.gov/scams.

To manage payments, check eligibility or opt out of the advance child tax credit payments visit IRS.gov/childtaxcredit2021.