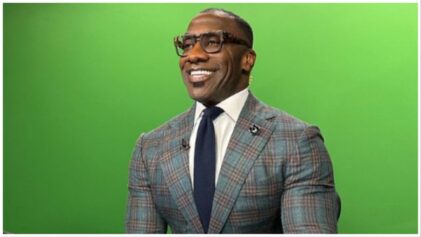

Retired NFL players Chad “Ochocinco” Johnson, Channing Crowder, Brandon Marshall and Fred Taylor spoke candidly about fiscal responsibility on a recent episode of their “I Am Athlete” podcast.

Entitled “What Athletes Do With Their Money,” the episode premiered Monday, Oct. 12. Covering everything from understanding when to say “no” to family and being frugal to making bad decisions with advisers, the men rehashed some of the challenges they faced while in the league.

“We got a lot of athletes watching, we got a lot of people watching and one of the biggest challenges that we all have, and I feel like is universal, is money,” Marshall said as they segued into the topic around the 9:25 mark of the video.

Marshall, who played 13 seasons in the NFL, spoke about the burden of what’s been dubbed the “Black Tax” — a phenomenon in which Black Americans who achieve success are expected to take care of their family members and friends.

“That’s a big challenge … When we make it, it’s almost like everybody make it,” Marshall said. “I know one of the biggest challenges for me — something I struggled navigating throughout the whole 13 years — was how to help friends and family.”

“It was tough on me because I was extremely family-oriented,” Crowder chimed in, adding that when he was drafted by the Miami Dolphins his family moved to Miami with him.

“Like B said, we made it. We made it; and that was a tough thing for me to just look at. I don’t just need to take care of myself,p; I just didn’t make it. I have to think about everybody. I have to try to set everybody up,” Crowder continued.

He acknowledged there was a “flaw” in having that mentality.

“As an older man now — I didn’t know this as a 20-year-old rookie — but as an older man now, you can’t save everyone,” Crowder said. “If you give all your money out, then you’re gonna be broke and you can’t help anyone.”

It’s a phenomenon many have seen play out all too well, particularly with professional athletes. In an article published in May, Investopedia highlighted some statistics of professional athletes going broke.

“According to Sports Illustrated, 78% of NFL players who are retired for only two years file for bankruptcy, and after five years of retirement, 60% of NBA players suffer the same fate,” the article said. “According to a study in the National Bureau of Economic Research (NBER) as well, close to 16% of the NFL players in the study that were drafted between 1996 to 2003 also filed for bankruptcy within just 12 years of retirement.”

To avoid becoming a statistic. Crowder said he shifted his mentality, stopped giving his family handouts and became some of their landlords. As a result, Crowder said “a lot of relationships broke.”

“I think for people with new money, you have to have uncomfortable conversations with your siblings, with your loved ones, because if we all are happy, we all are broke and that’s how I really feel about this whole conversation,” Crowder said.

Taylor agreed with his peers and said he was given sage advice by a teammate when he first got drafted.

“When I first got into the league, I had somebody say to me, ‘Hey, rook, you’re gonna have to learn how to tell your people no,’ and that was the hardest thing for me; saying no to people who helped me out on every aspect of getting to where I got,” Taylor added.

He also said he learned some hard lessons about who to trust in both personal and professional relationships.

“[It’s hard] figuring out who to trust — people come, they befriend you, and they tell you these are the things you need to do with your money,” Taylor said. “Being comfortable with a financial adviser, they have their philosophies and they’re doing it with your money, so when you don’t come from money and when you’re talking about financial awareness, or the lack of, that’s the biggest challenge for young guys who acquire or come into money.”

Taylor said he made a lot of mistakes, but the biggest was “not taking the time to learn these things.”

“Your financial adviser will tell you, ‘You go play ball, we’ll handle everything.’ I didn’t balance my x’s and o’s. I didn’t really put anybody else into position to watch over them,” Taylor said. “I trusted them, and it went south.”

Known for making headlines on and off the field, Ochocinco said he didn’t really have that problem. Coming from Miami’s Liberty City community, his circle was small, his friends already had money from their street dealings, and his grandfather modeled frugality for him.

“That mentality of fiscal responsibility was already in me before the money came through, so for me it was a little easier, and then I didn’t have a circle because my circle of friends come from or already had money because of what they did,” Ochocinco said.

Avoiding pointless expensive purchases and living in his team’s facility for the first two years he was in the league were some of the ways Ochocinco said he avoided falling victim to money mismanagement.

He described himself as intentionally “cheap” and prided himself on being the same way today.

“I’m 20 years in and I’m still straight; still living the same lifestyle I lived once I got drafted. If I want to show off, if I want to treat myself, I can do it. I can turn up, I can stunt, but it’s really not me.”

Feeling obligated to take care of everyone also wasn’t a concern, Ochocinco said.

“As far as family needing and wanting, if you weren’t there before, you wasn’t getting nothing just coming once I made it,” Ochocinco said.

Crowder summed up the plight of Black professional athletes who come from poor communities. “As soon as we got our first check we became the patriarch of all our families,” Crowder said.