Black people simply cannot catch a break, including Black homeowners. As the impact of the post-Great Recession era continues to play itself out, Black people are coming up short, their homes devalued by the housing market, just as their lives have been devalued since Day One in this country. This is particularly the case with wealthy Black homeowners, proving the insidious nature of institutional racism, and demonstrating that there is nothing “free” about a free market rife with racial discrimination.

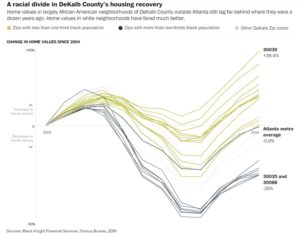

As The Washington Post reported, the situation in DeKalb County, Georgia in South Metro Atlanta is instructive. Even as white households are witnessing an increase in their home values in the so-called recovery, African-Americans are not partaking in this good fortune, as their home values drop and they continue to lose ground. Further, this is all about race, and nothing else.

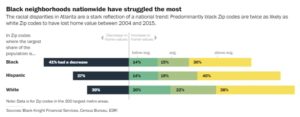

The Post noted that across America, home values in predominantly Black communities are the least likely to recover. For example, examining the 300 largest metropolitan areas in the U.S., homes are worth less than they were in 2004 in 40 percent of ZIP codes where Blacks are the largest group. Alarmingly, that is double the rate for majority white ZIP codes. Moreover, in the Atlanta metropolitan area, nearly 90 percent of mostly Black ZIP codes have homes that are worth less than they were a dozen years ago.

The Washington Post

The scope of the problem plays itself out in South DeKalb, which is predominantly African-American, and the mostly white North DeKalb. Homes in the former can sell for half of what identical homes would yield in the latter. In some areas of South DeKalb, property values are 25 percent lower than they were before the economic collapse, according to The Post. White families thrive while Black families suffer. And the region mirrors the interplay between race and housing throughout the U.S.

“Across the country, Blacks are less likely to own homes; those who did were more likely during the housing bust to slip underwater; and as a result, a larger share of Black wealth has been destroyed in the years since then,” The Post said.

Moreover, the disparities are taking place in South DeKalb County, where Black families enjoy six-figure incomes, showing this is also about more affluent Black people and not about poverty. One can point to the government policies and private practices over time that have acted to the detriment of African-Americans — who for years were denied access to mortgage lending and faced barriers to ownership — and yet were specifically targeted for predatory subprime loans in the lead-up to the collapse of the housing market.

According to sociologist Jacob Faber, Black families making $230,000 per year were more likely to have a subprime mortgage than a white family earning only $32,000. When the housing bubble burst, Black and Latino families across the U.S. were left with the tab and experienced an epic loss of wealth. This is about race, but also race within the context of vulture capitalism, and white financial institutions profiting from Black people.

The Washington Post

“We can all guess exactly why it’s race, and we can have theories, but the facts are clear,” John O’Callaghan, president of the Atlanta Neighborhood Development Partnership, told The Washington Post. “Values in South Metro Atlanta, particularly in African-American neighborhoods, are coming back very, very slowly. And it’s going to be a long time before we get these neighborhoods back to where they were.”

When home values fall, as they have in Black America and particularly affluent Black America, it creates a vicious cycle. When property values go south, this means there are fewer tax dollars available for government services and good public schools, making these communities less in demand, and further driving home values down. As a result, Black people cannot sell their homes, or refinance them, and they are left with negative equity — owing more on their homes than they are actually worth.

For many Black homeowners making it up the ladder, the rungs have been sawed off, turning the already elusive American dream into an American nightmare.