As the nation settles back down to a sense of post-election normalcy, Washington is facing a potential fiscal disaster, ominously called the “fiscal cliff,” that is a result of the failure of Republicans and the White House to come to agreement on a solution to the nation’s economic and tax woes.

The potential tsunami that could take $2,000-3,000 out of the pockets of the average American is a confluence of the expiration of the Bush tax cuts, the expiration of President Obama‘s 2 percent payroll tax cut, and a huge cut in government spending, all set to go into effect at the end of the year and which would take a combined $800 billion or so out of the U.S. economy at a time when the nation is just recovering from the Great Recession.

Ironically, the enormous cut in government spending—including a $55 billion reduction to the Pentagon’s budget in 2013, a reduction of payments to physicians participating in Medicare, substantial cuts to FEMA and the Dept. of Education—was put in place by the White House and Congress during the 2011 debt-ceiling fight as a measure to force the two sides to compromise in order to stop the cuts from taking place. In other words, the two sides agreed to massive cuts that it never intended to let happen as a way of motivating itself two years later.

The question now is, Did this strange motivating tool work? Will the two sides now come together and prevent an economic catastrophe—or will they let Americans suffer because of their deep dysfunction, sending the economy back into a tailspin?

In order to come to an agreement, they will have to compromise, which has proven almost impossible for the two sides. Particularly in the House, the word “compromise” has taken on evil connotations—and been used by conservative and Tea Party-influenced politicians to punish any who even consider it. That’s why we have had the specter this week of House Speaker John Boehner bouncing all over the place when discussing this issue. First, right after the election, he looked like he might be ready to sit down and act like a grown-up, saying the American people clearly voted for compromise.

But by Friday, he was back to his previous intransigence, no doubt after he heard from House Republicans who want no part of compromise, even if Obama did win handily and Democratic Senators practically swept the table among the key races.

“Well, clearly the deficit is a drag on our economy. And we can’t continue to spend money that we don’t have,” Boehner told reporters Friday, calling on the president “to lead.”

“It’s clear that there are a lot of special-interest loopholes in the tax code, both corporate and personal,” Boehner said. “It’s also clear that … there are all kinds of deductions, some of which make sense, others don’t.

“And by lowering rates and cleaning up the tax code, we know that we’re going to get more economic growth. It’ll bring jobs back to America. It’ll bring more revenue.”

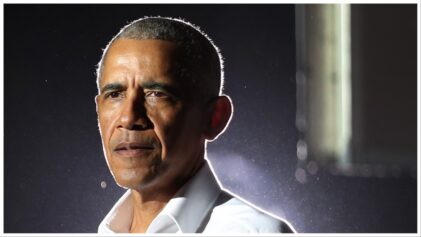

For his part, the president has said that he’s ready to compromise—up to a point. He wants to end the Bush tax cuts, but only for those Americans making more than $250,000 a year.

“I intend to work with both parties,” Obama said on Friday, but added, “We can’t just cut our way to prosperity.”

“I’m not wedded to every detail of my plan,” Obama said of proposals he has made in the last 18 months. “I am open to new ideas … but I refuse to accept any approach that isn’t balanced.”

The job now, he said, is to get a majority in Congress to cooperate.

“If Congress fails to come to agreement on overall deficit reduction package by the end of the year, everyone’s taxes will go up. … That makes no sense. It would be bad for the economy,” he said in urging tax cuts be extended for the 98 percent of taxpayers who make less than $250,000 a year while negotiations on the rest of the plan get under way.

Obama noted such a bill already has been passed by the Senate and awaits action in the House.

Obama warned the electorate won’t tolerate the government’s continued “dysfunction.”

But Boehner said he’s not ready to raise taxes on the top 1 or 2 percent of taxpayers.

“Listen, the problem with raising tax rates on the wealthiest Americans is that more than half of them are small-business owners. We know from Ernst & Young, 700,000 jobs would be destroyed. We also know that it would slow down our economy,” he said.

So we are back on the road straight to dysfunction and economic catastrophe as the entire nation—and the rest of the world that depends on the strength of the U.S. economy—goes flying off the side of the cliff.