For many low-income African-Americans, a lack of access to banking products means that high-interest loan products — such as payday loans — are an everyday reality. (Courtesy: Flickr)

Samantha Gregory is a personal finance blogger. When she was younger, she faced a financial reality that afflicts nearly 34 million Americans.

“There was a period in my life when I was unbanked,” Gregory told Atlanta Black Star. “I could not get approved for an account for a number of reasons. The main reason was I had a written a bad check in my younger years and it was following me around in ChexSystems for regular banks and for a credit union I wanted to join. I was also told the reason for rejection was my credit score was too low.

“The ramifications were I could not deposit my paycheck, so I had to briefly use a check cashing place and be subject to their high fees. At the time I was low income, so these fees ate into my already small paycheck.”

According to a 2015 FDIC national survey, seven percent of all households in the United States are “unbanked” or have no access – voluntarily or by circumstance – to any bank product. An additional 19.9 percent are “underbanked” or possessing a checking or saving account, but also relying on financial services, such as prepaid cards, sub-prime loans, and check-cashing services, that originated outside the banking system.

With more than 55 percent of all African-Americans households being either “unbanked” or “underbanked” as of 2014, this situation represents a key component of the wealth disparity gap gripping the Black community.

Without access to credit or to banking solutions, the cost of living grossly increases. A lack of access can effectively limit housing choices, the price and availability of critical services such as utilities and insurance, the ability to raise capital for new business opportunities and to maintain tax and financial accountability for existing companies, and even job opportunities.

Additionally, many people believe the Bank fee structure is no longer about saving your money but is now about how to extract portions of your money while in the bank. “If a large percentage of your income is going to transaction costs, that’s money you’re not putting into consumption,” Yale sociologist Frederick Wherry said to YaleNews. “If every time you’re making a transaction you’re losing 15%, 20%, 30% on it, you’re not saving or spending it in some other way.”

“This is the sleeper social justice issue of our time. How many subprime households do we need to have before people are ready to talk about this? What about students trying to access higher education who are finding themselves financially strapped and stigmatized in the financial system? That’s a hard way to start life.”

Maintaining Good Credit

On September 7, Equifax — one of the nation’s big three consumer credit reporting firms — reported that the company was subjected to a data breach that put about 143 million — or slightly less than two in every five — Americans at risk of their personally identifiable information being stolen. This follows an earlier March hack that the company says is unrelated to the massive intrusion disclosed on September 7.

Credit reporting companies are business-serving companies that monitor and ascertain risk assessment for banks, credit card companies, and other credit-dependent businesses. As these companies typically do not offer primary services to consumers, most consumers do not have an immediate relationship with them.

However, these companies are intimately tangled in the financial lives of all Americans. Whenever someone or some business makes an inquiry into a credit record, a note of that inquiry is made in the record. Depending on the policies of the credit-granting company, transactions (or the lack thereof) are recorded in the record, as are request to open new accounts.

For the unbanked and the underbanked, the last point is important. Credit is defined as a payer’s trustworthiness to pay a debt in full and on time. Typically, any creditworthy activity, such as paying rent and utility bills on time, should positively add to a consumer’s credit record. However, not all of these businesses report to the credit reporting firms. The information that is gathered tends to be sparse and creates an incomplete credit history. For the 35 to 54 million Americans that fall into this category, per the Policy Economic Research Council, this creates a situation where requests for new bank services are routinely rejected as high risk. This creates a “churn cycle,” in which “unbankable” consumers apply for consumer credit products, get rejected, and apply again. This is adding to the credit reporting database.

While this, in itself, is only marginally worse than the circumstances facing anyone else whose data is stolen, the situation compounds when the unbanked and underbanked do not have the financial literacy to check their credit scores and correct their credit histories. This makes possible credit hacks financially lethal to those least capable of coping with them. This churn cycle breeds a lack of trust that proliferates the unbanked/underbanked situation.

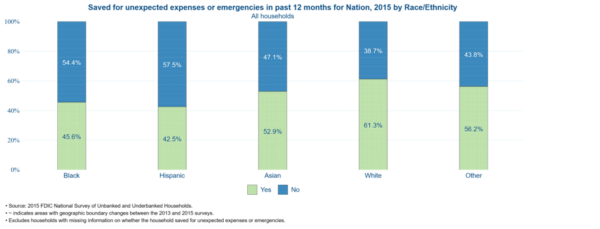

Per the 2015 FDIC National Survey of Unbanked and Underbanked Households, African Americans and Latinx families are less likely to have emergency savings than white families. (Courtesy: Federal Deposit Insurance Corporation)

Financial Literacy

The Black community has a rocky history with banks in the United States. After Reconstruction many banks, particularly in the South, discriminated against African-Americans. This hit its stride in the 1930s, when redlining — or the active denial of housing, insurance, banking, or other critical services to those of a specific ethnicity in a defined area — was introduced with the passage of the National Housing Act. The act took its name from Home Owners’ Loan Corporation maps, which marked the least desirable areas for mortgage allocation.

“As a consequence of redlining, neighborhoods that local banks deemed unfit for investment were left underdeveloped or in disrepair,” Brent Gaspaire of the University of Washington, Seattle wrote. “Attempts to improve these neighborhoods with even relatively small-scale business ventures were commonly obstructed by financial institutions that continued to label the underwriting as too risky or simply rejected them outright.

“When existing businesses collapsed, new ones were not allowed to replace them, often leaving entire blocks empty and crumbling. Consequently, African Americans in those neighborhoods were frequently limited in their access to banking, healthcare, retail merchandise, and even groceries.”

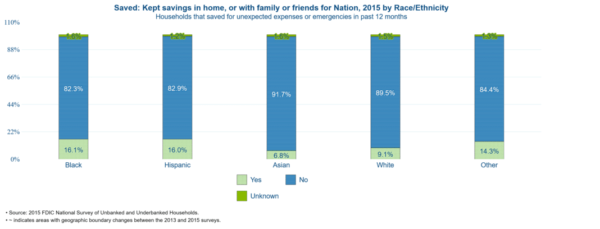

The results of this are striking. A 2015 FDIC study found that African-Americans and Hispanics are less likely to have savings available to hedge for emergencies or unexpected events, less likely to have an interest-bearing savings account, and are more likely than Asian or white consumers to keep their money at home or with a friend because of a distrust of the banking system.

“Plain and simple, the cost is wealth,” wealth adviser Jason Howell said. “Generations of so-called underbanked populations of color have missed the gateway financial planning that having a checking or savings account provides. As families within these populations learn the benefits of banking, the mythology around distrust tends to fade.”

Per the 2015 FDIC National Survey of Unbanked and Underbanked Households, African-Americans and Latinx are more likely to save money in non-traditional locales, such as at home or with a family relative. (Courtesy: Federal Deposit Insurance Corporation)

Systematic Controls and Risk Pools

Another aspect of being unbanked/underbanked is those who don’t use bank services often find themselves in the high-risk pools for insurance or other credit-dependent services.

An example is life insurance. Anthony Martin, the owner and CEO of Choice Mutual, an independent agency that offers burial and final expenses insurance, explained, “Life insurance is a low-profit-margin industry. Most plans do not make money for the underwriter until the second or third year. So, subscribers that are likely to leave in the first year are not preferred.

“As a matter of fact, agencies that tend to bring in a large number of these types of customers get closed down quickly. Many of these policies require bank drafts for monthly payments, with the few that allow alternative payments usually charging higher premiums and other requirements, such as not being able to make a claim or withdraw for two years. It can be confidently said that this is not a coincidence; those most likely to drop their policies early are also most likely not to have a checking account or to be able to pay for the policy upfront.”

The choice to not be banked means that a consumer may be unintentionally marking himself as a high-risk consumer. This can make a significant difference in the rates the consumer may get for car insurance and auto and housing loans, and may make a difference in the consumer’s ability to secure these lines of credit in the first place.

Being unbanked or underbanked makes a difference when starting or expanding a business as well. “From a small-business standpoint, there are huge disadvantages to being unbanked,” Deltrease Hart-Anderson, enrolled agent to the IRS and partner in D. Hart Accounting Practitioner, said. “Not having a business bank account as a business owner could leave you open to unfavorable IRS tax audits. You should never co-mingle business and personal funds. If you have both income from a business and non-business income being deposited into a non-business bank account, the IRS may consider all of the income deposited as business income. This could result in you paying more taxes. Examples of non-business income could be income from a job where you receive a paycheck, child support, alimony, social security, monetary gifts, etc.”

“Unbanked/underbanked business owners are also at a disadvantage when they want to make large purchases of vehicles, machinery and equipment to expand their business and even homes. In most cases, these purchases may require business owners to show proof of income and expense activity through bank account transactions. If there were not a bank account, the loan would be denied.”

Resolving the Gap

Solving this problem is not as easy as giving everyone a banking account. In the aftermath of the Great Recession, the banks have retreated from microlending or offering small-dollar credit. Even if there was a bank that offered such lending, low-income borrowers would not qualify for them.

This phenomenon leaves the door open for abusive lending practices, such as payday loans, which could have an APR of 5,000 percent over a repayment period of seven days. Per the Pew Trust, this amounts to the average payday loan customer being subject to $140 per day. However, customers will still utilize these services — despite the fees — because of limited and restricted access to traditional banks.

The banking industry must take a serious look at developing trust and new products geared toward smaller account holders in order for the “unbanked” issue to be resolved. With the average checking disclosure being 111 pages long, one way the banks can do this is by increasing transparency with fees and privacy protection. Additionally, the banking industry must be willing to offer and support alternative products, like cryptocurrency wallets, prepaid cards, and secured lines of credit that would give consumers more control of their assets.

The other part of this equation is education. Financial literacy is not a topic that is typically discussed in Black and Hispanic families; teaching consumers about financial responsibility and proper money management at a young age can help to create the practices needed to reverse the legacy of mistrust that is helping to proliferate the disparity gap.

“Different people fall in different spectrums of the banking experience. Not everyone is looking to open a business. For many African-American and Latino people who do not bank at all, the idea of trusting an institution with their earnings or assets is terrifying. It is terrifying because the banks were and are one of the biggest symbols of oppression for people of color,” Ismael Mayhew, owner of the consultancy firm Ish Content, said.

“I don’t think banks adequately or equally cater to communities who as a whole are not finally literate in the standard American banking system; a system that has a known history of excluding or exploiting people of color.”