4closureFraud.org

When it comes to the mortgage industry, the war on Black and Latino people continues. Simply put, the rates are too high, and the loans are too few.

A paper published for the National Bureau of Economic Research examined racial and ethnic differences in mortgage lending in seven metropolitan areas. The authors — economists Patrick Bayer, Fernando Ferreira and Stephen L. Ross — found that even after accounting for credit scores and other risk-related factors, African-Americans are 105 percent more likely to have high-cost mortgages, and Latinos are 78 percent more likely. According to the report, 60 to 65 percent of this difference is attributable to sorting across lenders, or differential access to lenders, meaning that Blacks and Latinos only have access to high-risk lenders in their community. These lenders aggressively target communities of color with pricier mortgages. Meanwhile, 35 to 40 percent of the higher interest rates are due to disparate treatment of equally qualified borrowers by mortgage lenders.

“Taken as a whole, the results of our analysis imply that the substantial market-wide racial and ethnic differences in the incidence of high-cost mortgages arise because African-American and Hispanic borrowers tend to be more concentrated at high-risk lenders,” the report said. “Strikingly, this pattern holds for all borrowers, even those with relatively unblemished credit records and low-risk loans. High-risk lenders are not only more likely to provide high-cost loans overall, but are especially likely to do so for African-American and Hispanic borrowers,” the study added. “In fact, these lenders are largely responsible for the differential treatment of equally qualified borrowers; minimal racial and ethnic differences exist among lenders that serve less-risky segments of the market.”

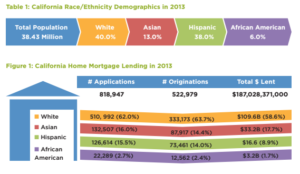

These findings come just as another revealing study was released on racial differences in mortgage lending in California. The report, jointly produced by the Greenlining Institute and Urban Strategies Council, examined the mortgage markets in Oakland, Long Beach and Fresno in 2013. While the majority of Californians — 57 percent — are Asian, Black or Latino, they only received 28 percent of the mortgage dollars, or less than half their share of the population. Of the $187 billion in mortgages funded by lenders in that state, only $53 billion went to borrowers of color.

The Greenlining Institute

The study noted the low number of mortgage applications among Black and Latino home buyers. Blacks are 6 percent of the California population, yet submitted 2.7 percent of the applications and received 1.7 percent of the mortgage dollars. And Latinos, who are 38 percent of California residents, had 15.5 percent of the mortgage applications but received only 8.9 percent of the mortgage funds.

“As the nation recovered from the recent economic crisis, the majority of Californians were locked out of the 2013 housing market — missing the most affordable time to buy a home,” the study found. “44% of California’s residents — the combined African-American and Hispanic populations — obtained just 10.5% of total mortgage dollars lent by the top 12 lenders statewide. Sadly, these disparities were more pronounced in three cities where African-Americans and Hispanics averaged 56% of the population.”

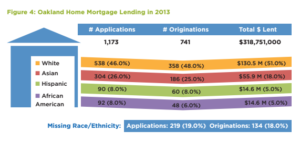

The Greenlining Institute

Oakland is a particularly glaring case of racial disparities. The top 12 lenders gave mortgages to only four Blacks and seven Hispanics in that city. In Long Beach, Asians lagged behind in mortgages, while whites exceeded their population share in mortgages. In addition, while Fresno had the highest lending activity of the three cities, Blacks and Latinos lagged behind. Latinos are 48 percent of Fresno’s population but received 21 percent of the mortgages, while Blacks are 8 percent and 3 percent, respectively.

The report concluded that while it cannot fully account for the ethnic and racial disparities, there are a number of steps that banks can take to establish better connections with communities of color. For example, these institutions should hire more diverse loan officers, market to communities of color, improve partnerships with credit counseling agencies, and create mortgage products tailored to low- and moderate-income people.

After the Great Recession — in which banks targeted Blacks and Latinos with subprime mortgages, causing us to lose wealth at historic levels — not much has changed with the financial exploitation of our communities by vulture capitalists and their race-based lending practices.