The wealth gap between the top 0.1 percent of American households and the bottom 90 percent has grown wider that it has ever been since the Great Depression, with the wealthiest families being worth the same as the bottom 90 percent.

Over the past 30 years, the rich in America have only grown richer and the poor have continued to grow poorer.

The bottom 90 percent of American families has been faced with rising debt, stagnant wages and the collapse of the value of their assets during the recession.

With the top 0.1 percent not facing nearly as many financial obstacles, the wealth gap has grown to a point that prompted Federal Reserve chairwoman Janet Yellen to question if the U.S. is even staying true to its founding principles.

“The extent of and continuing increase of inequality in the United States greatly concern me,” Yellen said in October during her “Perspectives on Inequality and Opportunity from the Survey of Consumer Finances” speech. “The distribution of income and wealth in the United States has been widening more or less steadily for several decades, to a greater extent than in most advanced countries.”

Yellen went on to say that the gap’s very existence is a contradiction of the values that are supposed to be at America’s core.

“I think it is appropriate to ask whether this trend is compatible with values rooted in our nation’s history, among them the high value Americans have traditionally placed on equality of opportunity,” she continued.

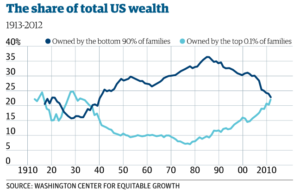

According to research published by the Washington Center for Equitable Growth, the total household wealth of the top 0.1 percent rose to 22 percent in 2012, up 15 percentage points since the late 1970s.

In dollars, the top 0.1 percent of American households had an average of more than $20 million in net assets in 2012.

Meanwhile, the average family in the bottom 90 percent of American households was worth $80,000.

Unfortunately, there are no signs that the wealth gap will be closing any time soon.

According to Yellen, the U.S. needs to shift its focus on giving more resources to children, creating affordable higher education and boosting business ownership in order to close the massive wealth gap.

Until then, Yellen said, the value that America once placed on “intergenerational mobility” will continue to be “undermined.”