Kenyan financial services heavyweight Equity Bank is planning to roll out mobile banking services in July, using innovative paper-thin SIM technology.

The bank will provide its account holders with slimline SIMs that they can lay on top of their existing mobile phone SIM cards.

This will allow customers to maintain their existing phone numbers and services, but give the bank access to the phone menu and ensure that banking transactions are secure.

The “mobile virtual network” banking service will piggyback on existing infrastructure provided by leading telecommunications firm, Bharti Airtel.

With more than eight million customers, Equity Bank is Africa’s largest bank by customer base.

The company is hoping that mobile banking will help attract new customers and encourage more transactions.

It is likely to shake up a market that has been dominated by Safaricom’s well-known M-Pesa mobile money transfer platform.

M-Pesa now has more than 18 million active users, but Kenyans also use rival services such as Zap and yuCash.

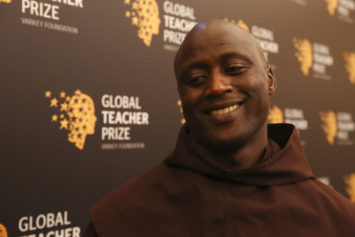

Describing its traditional competitor as “the mattress” – in other words, the place where people hide their cash – Equity Bank’s chief executive James Mwangi sees its mobile offering as key to breaking down barriers of access and distance that hamper banking in Africa.

“The biggest problem with accessing a bank is not bank charges, it is the cost of access,” he says.

“I will have to go 70km to where the bank is; I will have to pay public transport; I will have to spend the whole day to get to the bank; I have to dress because I have to go to the biggest shopping centre in my district; that is what will be removed,” he says.

Equity has been looking to launch the technology since the regulator, the Communications Authority of Kenya, granted Equity’s subsidiary Finserve – along with two other companies – a mobile virtual network operator license in April.

The bank, which has customers across East Africa, is also hoping to benefit from Airtel’s regional reach – the Indian-owned company operates in 17 countries across Africa, including Uganda, Rwanda and Tanzania.

“It is really the issue of affordability,” Mwangi says. “If we really want the masses and the low-income people to join banking, then we should make financial products very affordable, and that is the value proposition that we are making to the market.”

Read more at www.bbc.com.