Less than a decade has passed since Dell was the gold standard in PC sales. Eschewing retail stores in favor of a website where shoppers could customize their own laptops, Dell offered low-cost, well-designed computers and built a supply chain that was the envy of the industry. Today the company announced a plan to shed $2 billion in expenses, setting the stage for a new round of cutbacks and layoffs. What happened?

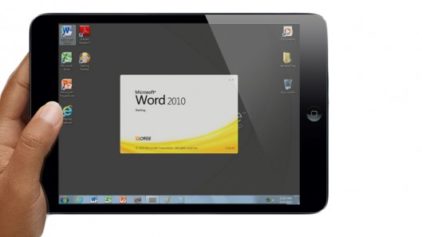

In a word: tablets. Introduced in early 2010, Apple’s iPad signaled a new era in personal computing, one in which the traditional PC appears destined to play an ever more sidelined role. The streamlined form factor hit Dell hard in what had always been its core operations: Windows-based desktops and laptops. Asian competitors like Lenovo and Asus also offered stiff competition on the low end of the market.

Several years ago, after Dell’s growth began to slow, Michael Dell stepped back into the CEO role to turn things around, pushing the company into software and IT services. But the PC business has continued to decline: Revenues from notebooks fell 10% in the most recent quarter, and the company cited iPads and other tablets as the main culprit. Even so, PCs still account for about 54% of Dell’s total revenue.

Not for much longer, though. Following a slump in Dell’s share price that has shrunk its market value by a third since February, Michael Dell told analysts today that the company will cut its costs by $2 billion during the next three years. Bearing the brunt of the cuts: Dell’s once-thriving PC business.

The restructuring will accelerate Dell’s push into IT services, consulting and software, areas of tech already dominated by big names like IBM and HP. The company estimates enterprise solutions and services will make up 31% of revenue by early next year, up from 23% in 2008. Dell described the company’s software business as “modest” but holding more growth potential than its aging PC business. It is capable of making Dell a company “unencumbered by a legacy of old stuff,” he said.

Dell’s stock closed up 2.6% Wednesday at $12.27 a share. On Tuesday, the stock traded as low as $11.68 a share, its lowest level in nearly two years. As recently as 2005, the stock traded above $40 a share.

Dell isn’t alone in having an aging PC business hanging like an albatross around its neck. HP bought Compaq in 2002, and its PC division still comprises 31% of its revenue. But HP pushed into IT services much earlier, and the slowdown in PC sales hasn’t weighed as much on its shares. HP, however, has considered spinning off its PC business into a separate company, a move favored by some of its investors.

Apple’s desktop and notebook computers made up only 13% of its revenue last quarter, but the company has mined the high end of that market with a design that appeals to that niche. Only a small portion of the PC market is willing to pay the prices Apple charges, but it keeps Apple from competing with low-cost PC from Asian manufacturers. Apple has instead focused on lower-cost devices like the iPad and the iPhone, which make up 17% and 58%, respectively, of its total revenue.Despite the rise of tablets, the PC market isn’t going away any time soon, especially in the enterprise market. But neither is the PC market the growth industry it was for two decades. In fact, it’s becoming more of a commodity market, one that Lenovo, Acer and others are very good at competing in. The real growth is in designing and innovating new devices, like smartphones and tablets. And despite its best efforts, Dell hasn’t emerged as much of an innovator in either of those new markets.

Michael Dell told analysts the tech industry is “constantly in transition.” And so, it seems, is Dell. But it’s one thing to be leading the charge and another to be changing horses just to keep up. With today’s announcement, Dell has shifted decisively from the former to the latter.

Source: ReadWriteWeb