Africa is home to some of the world’s fastest-growing economies, with many of them relying on oil for foreign exchange.

It is estimated that 57 percent of Africa’s export earnings come from hydrocarbons. Proven oil reserves have grown by almost 150 percent, increasing from 53.4 billion barrels since 1980, to 130.3 billion barrels by the end of 2012.

The region is home to five of the top 30 oil-producing countries in the world, and nearly $2 trillion of investments are expected by 2036.

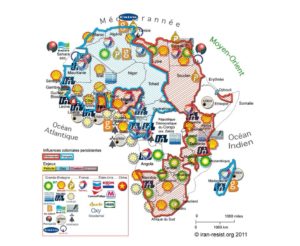

Due to these conditions, the interest of Europeans, Americans and Chinese remains high in the continent.

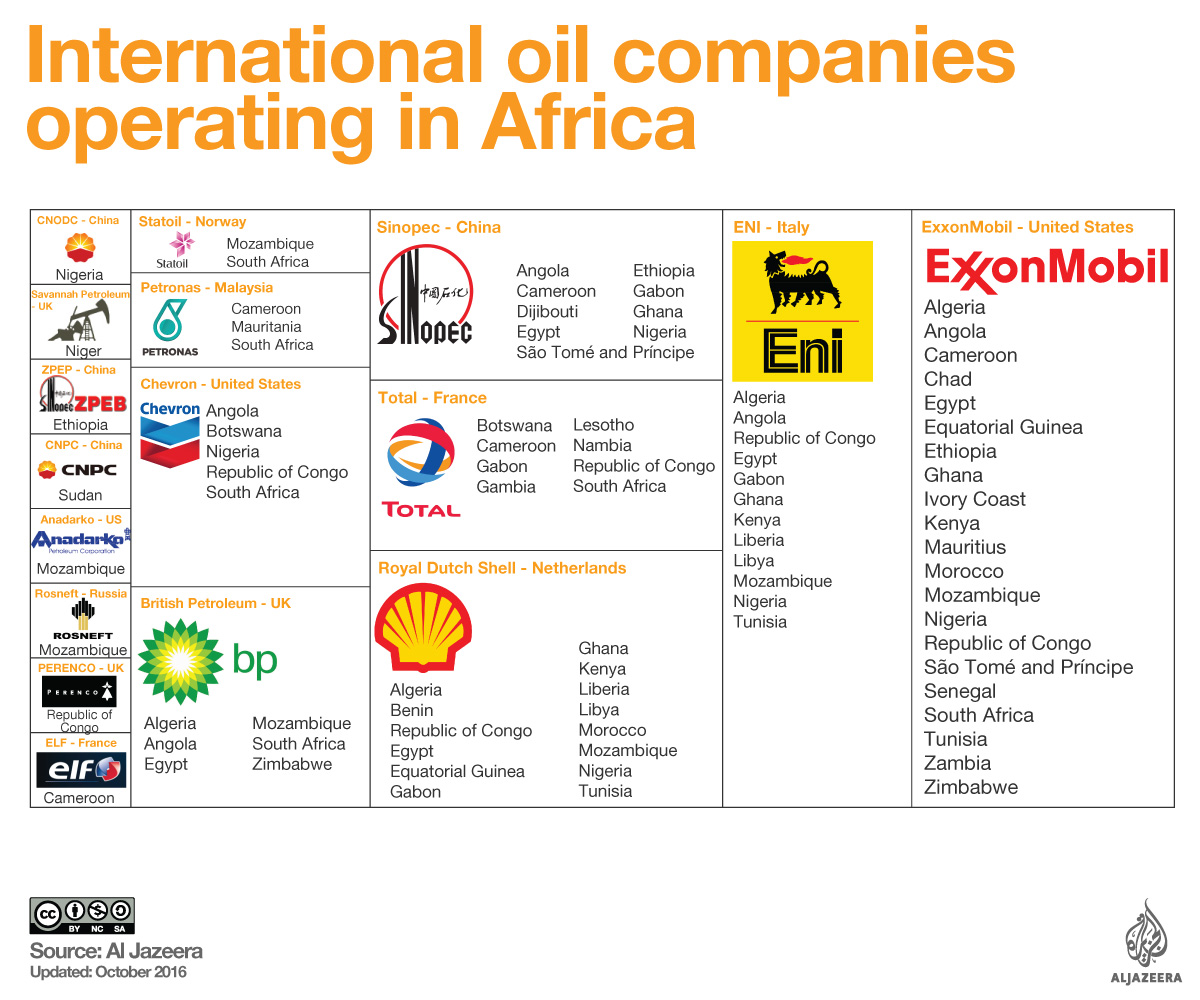

American oil company ExxonMobil is one of the largest foreign investors in Africa. Over the last years, it has committed more than $24 billion to energy exploration and development.

Italy remains close. ENI, an Italian multinational oil and gas company, plans to invest around $25 billion mainly in oil and gas, representing 60 percent of the company’s investment.

China is the world’s second-largest consumer of oil, and it’s projected to become the world’s largest consumer by 2030. It is estimated that the country will import over 66 percent of its total oil by 2020, and 72 percent by 2040. Its second-largest source of crude imports is Africa.

The interest of major U.S. energy companies in Africa has not decreased, and the needs of Asia and Europe will not stop growing.

“We all know oil resources are becoming increasingly rare. The last major reserves of oil in Africa will become increasingly important. Pre-positioning oneself with a view to exploiting these resources is vital,” says Jean Batou, professor of history at Lausanne University, in the documentary titled, “Shadow War in the Sahara.”

Read more here.