President Obama is gearing up to wade once again into the tangled weeds of the Bush-era tax cuts, an issue on which he has been tangling with Congressional Republicans since he took office nearly four years ago.

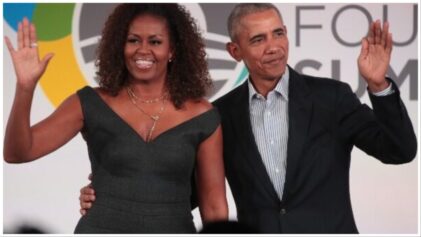

In remarks today at the White House, the president resurrected Republican accusations of class warfare by stating that the Bush tax cuts on people making more than $250,000 needed to end, but the tax cuts for those making less than that should continue.

Speaking in the East Room of the White House, Obama said he wants to break through the “stalemate” over taxes and that the cuts for the wealthy needed to end because “we can’t afford to keep that up.” Obama called on Congress to extend the rates, for one year, for families earning less than $250,000.

“We don’t need more top-down economics,” Obama said. “We need policies that grow and strengthen the middle class.”

This was an issue that caused an endless skirmish two years ago when Obama tried to let the tax cuts expire at the end of 2010, while the Republicans wanted them extended indefinitely. After a big battle, the two sides came to the compromise to extend the cuts for two years, in effect procrastinating on a real resolution until 2012. Well, the two years are now up and Washington once again will have to engage on the question of what to do about the cuts—although this time there will be far worse distractions with a November election hanging over both sides. Neither side will want to agree to anything until they know what happens in November. If Romney wins, Republicans think they might be able to extend the cuts forever because Mitt Romney is also opposed to letting them expire, but if Obama wins re-election another compromise will need to be reached.

Though there has been much disagreement about the cost of the cuts over the last decade and the impact of extending the cuts, the non-partisan Congressional Budget Office estimated in June 2012 that the Bush tax cuts added about $1.5 trillion to the debt between 2001 and 2011. Two years ago, the CBO estimated that extending the tax cuts for the 2011-2020 time period would add $3.3 trillion to the national debt. In addition, the nonpartisan Pew Charitable Trust estimated that limiting the extension to individuals making less than $200,000 and married couples earning less than $250,000 would increase the debt about $2.2 trillion in the next decade.

In response to the president’s announcement, Mitt Romney’s campaign used it as a chance to talk once again about Obama and the economy. “President Obama’s response to even more bad economic news is a massive tax increase. It just proves again that the president doesn’t have a clue how to get America working again and help the middle class,” spokeswoman Andrea Saul said in a statement.

But from Obama’s perspective, talking about Romney and taxes gives him an opportunity to highlight Romney’s $250 million personal wealth and his offshore bank accounts.

“We have to continue to grow our economy. We have to grow it from the middle class out,” Obama campaign advisor Robert Gibbs said Monday in an interview on NBC’s “Today” show. “But for millionaires and billionaires, they don’t need a tax cut,” he added.