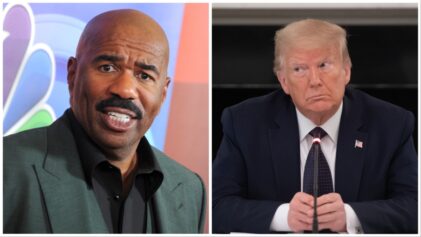

A former contractor for the IRS was sentenced to five years in prison Monday after pleading guilty to leaking tax information about former President Donald Trump and thousands of other prominent U.S. citizens.

Charles Edward Littlejohn, 38, of Washington, D.C., received the maximum sentence for leaking the tax records to The New York Times and ProPublica between 2018 and 2020, as he sought to damage Trump while he was still in office.

U.S. District Judge Ana Reyes scolded Littlejohn, saying his crime undermined trust in the nation’s tax system.

“When you target the sitting president of the United States, you target the office,” Reyes fumed. “It cannot be open season on our elected officials.”

In addition to the five-year sentence, Reyes imposed three years of probation and a $5,000 fine, after expressing surprise that Littlejohn faced only one felony count of unauthorized disclosure of tax returns and return information.

Before being sent away, Littlejohn apologized and said he took full responsibility for his actions.

“I acted out of a sincere, if misguided, belief I was serving the public interest,” he told the judge. “My actions undermined the fragile trust we place in government.”

Moments earlier, defense attorney Lisa Manning asked the judge for leniency since Littlejohn did not have a criminal record, but Reyes rejected that argument, citing the exceptional nature of the crime, which she said justified a sentence that would “deter others who might feel an obligation to break the law.”

Prosecutors pushed for the maximum sentence of five years to send “a strong message that those who violate laws intended to protect sensitive tax information will face significant punishment,” said Nicole Argentieri, acting-assistant attorney general of the Justice Department’s criminal division.

The charging documents against Littlejohn refrained from explicitly naming Trump, however the description’s and timeline closely align with news reports that emerged on Trump’s tax returns in recent years after Trump parted with a longstanding tradition among presidential candidates to disclose his federal tax returns.

The 2020 report published by The New York Times revealed that Trump paid only $750 in federal income tax during the year he became president. The report further highlighted instances when Trump paid no income tax at all in certain years due to significant financial losses.

At the time, the Democrat-controlled House Ways and Means Committee released six years of Trump’s tax returns, which revealed he paid little to no taxes during the first and last year of his presidency.

Meanwhile, a simultaneous ProPublica investigation uncovered a substantial collection of tax-return data concerning the 25 wealthiest Americans, who were found to contribute a much smaller percentage of income taxes compared to regular working people.

The leak also reportedly ensnared the tax records of Republican Sen. Rick Scott, of Florida, who said the Justice Department went easy on Littlejohn as he should have faced additional charges because his crime targeted multiple victims.

Littlejohn applied for a position with the Internal Revenue Service with the specific goal of obtaining Trump’s tax returns. Court documents revealed that he meticulously devised a plan to extract the tax data while ensuring that his actions wouldn’t raise suspicions among his colleagues.