An Indianapolis woman has filed a complaint in conjunction with the Fair Housing Center of Central Indiana after her home valuation jumped by $100,000 when she removed Black identifiers from her home and had a white friend sit in for her during the appraisal.

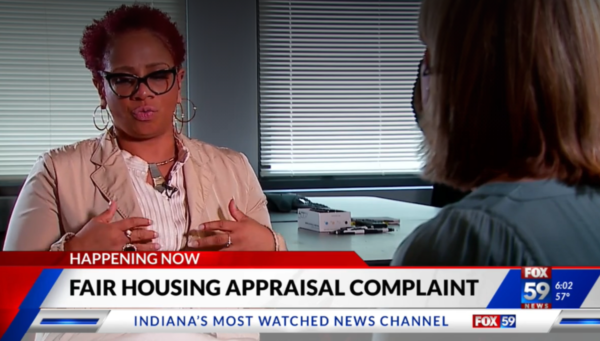

“I get choked up even thinking about it now because I was so excited and so happy, and then I was so angry that I had to go through all of that just to be treated fairly,” Indianapolis homeowner Carlette Duffy told local station Fox29.

Duffy made the decision to refinance her home located in a Black neighborhood near downtown Indianapolis last year, and had plans to use the equity to purchase her grandparents’ home close by in order to fix it up and keep it in the family.

When two appraisals came back close to what she bought the home for in 2017, leaving her with little equity, Duffy pushed back without success.

“When I challenged it, it came back that the appraiser said they’re not changing it,” Duffy said.

The appraisals came back at $125,000 and $110,000, after Duffy purchased her home for $100,000 three years prior, although it had been almost completely renovated following a fire.

Duffy, a city employee, decided to conduct an experiment after seeing FHCCI Executive Director Amy Nelson speak to a community group about discrimination in home appraisals. When she reached out to a third lender for an appraisal, this time she declined to disclose her race or gender on the application.

“I took down every photo of my family from my house,” Duffy said. “I took every piece of ethnic artwork out, so any African artwork, I took it out. I displayed my degrees, I removed certain books.” Duffy also asked a white male friend to sit in on the appraisal after telling the appraisers she would be out of town and that her brother would be present for the process.

The third appraisal returned an estimated value of $259,000.

“Only when I removed myself did I increase the value,” Duffy said. “So I’m being seen as the object of devaluation in my home, and that part hurts. That’s the part that’s hard to get over.”

FHCCI then filed complaints with the U.S. Department of Housing and Urban Development (HUD) on behalf of Duffy, alleging racial discrimination.

According to Nelson, in the first two appraisals, comparable sales were pulled from Black neighborhoods a mile away from Duffy’s home, although other homes in close proximity were better matches to the specifics of the home.

“Whether or not those comps were fairly selected is something that is the basis of the complaints that we have filed,” Nelson said.

According to the complaint, the appraisers violated Title VIII of the Civil Rights act of 1968.

Duffy was ultimately able to use the equity from the home to purchase her grandparents’ home, and she said her decision to challenge the situation was based on the desire to prevent something similar from happening in the future.

“I’m doing this for my daughter and I’m doing this for my granddaughter, so that when they come against obstacles they will know that you can stand up, you can say that this is not right,” Duffy said.

A study published last week by a national real estate brokerage estimated that Black homeowners are missing out on significant equity as homes in Black neighborhoods were devalued by an average of $46,000 between 2013 and February 2021.

Teresa Whitehead, CEO of Citywide, a lender Duffy worked with early last year, suggested the third appraisal’s jump in value could potentially be attributed to changes in the mortgage business in the year of the pandemic.

“We did see values go up considerably in a short period of time last year,” she said.

HUD is investigating to determine if any laws were violated.