California-based financial services company Stripe has acquired the Nigerian payments startup Paystack in order to expand its services to the African continent.

The multi-million dollar deal will allow both companies to operate independently. TechCrunch said the agreement is valued at more than $200 million.

As Stripe expands internationally in the months following a $600 million capital infusion in April, the recent deal has made the Nigerian startup the latest African tech company to snag a multi-million-dollar deal. The agreement is also the largest ever startup acquisition of a Nigerian company and Stripe’s biggest acquisition to date. Stripe is currently valued at around $36 billion.

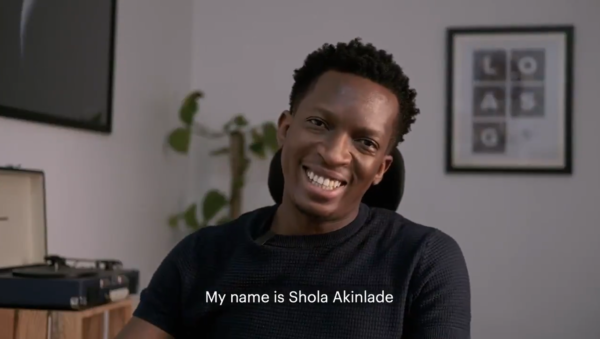

The Lagos-based company Paystack, which was founded in 2015 by Shola Akinlade and Ezra Olubi, allows businesses to accept payments online through credit and debit cards. Users can use the service to accept payments for a short weekend project, or for more complex services to receive payments from hundreds of thousands of customers. It employs 114 people, has expanded to Ghana and South Africa, and makes revenue each time a transaction is made.

The idea for the company was first conceived when Akinlade built a system to integrate a card transaction into a webpage for fun.

Paystack has attracted more than 60,000 users over the past five years. Its clients consist of government agencies, small businesses, and large corporations. In 2016, it became the first Nigerian startup to go through Y Combinator, a seed money startup accelerator that launched companies like Reddit, Dropbox, and Airbnb.

The company is similar to Stripe and has been referred to by TechCrunch as “the Stripe of Africa.”

“In absolute numbers, Africa may be smaller right now than other regions, but online commerce will grow about 30% every year. And even with wider global declines, online shoppers are growing twice as fast. Stripe thinks on a longer time horizon than others because we are an infrastructure company. We are thinking of what the world will look like in 2040-2050,” Stripe CEO Patrick Collison told TechCrunch.

Stripe was one of several companies that raised $8 million in funding for the startup in 2018.

Paystack’s Akinlade said the agreement will help the company expand and tap into other markets. Akinlade said the deal was “a natural move” because he is passionate about enhancing payment services in Africa and believes Stripe will accelerate this mission.

“For us, it’s about the mission. I’m driven by the mission to accelerate payments on the continent, and I am convinced that Stripe will help us get there faster,” he said.

Former Nigerian vice president Atiku Abubakar tweeted a proud message about Akinlade and Olubi after news of the deal became public.

Akinlade didn’t provide many details about what is up next for Paystack, but he hinted that the company will break new ground on the African continent. “Most of what we will be building in Africa has not been built yet,” he said.