Black city council members are taking New York Mayor Bill de Blasio’s administration to task for a city home seizure program they say takes valuable properties away from minority homeowners “too broadly and carelessly.”

In one case, an elderly owner of a multi-million dollar Brooklyn brownstone had paid her water bill with an incorrect account number and then discovered that the city—as part of its Third-Party Transfer program —had seized her home, according to City Journal.

De Blasio’s Housing Preservation and Development Commissioner Louise Carroll defended the program on July 22 at a contentious hearing.

She said in a Crain’s New York article that her agency uses third-party transfer only as a “tax enforcement mechanism” for properties with outstanding bills of more than $1,000.

The city impounded only 62 of the 420 properties it most recently identified as susceptible to takeover, she said.

Carroll also said that “everything is on the table” regarding possible changes to the program, according to BKLYNER, a Brooklyn news site.

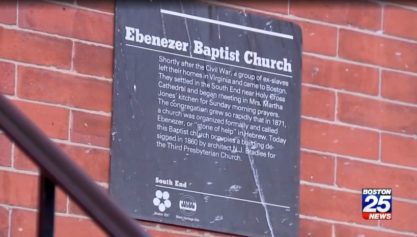

The Third Party Transfer program was founded under New York Mayor Rudolph Giuliani’s administration in 1996 as an alternative to tax lien auctions, which affect property owners who fall too far in arrears on property taxes or city water and sewer fees.

Related: Is Mayor Bill de Blasio’s Administration Targeting Black, Latino Communities for Foreclosure?

The Third Party Transfer program allows the city’s Department of Housing Preservation and Development to transfer neglected, tax-delinquent buildings to nonprofits that could rehabilitate and manage them with income restrictions geared to working-class people, City Journal reported.

“This process spared the city from having to assume possession of buildings and take responsibility for remaining tenants,” Seth Barron, an associate editor of City Journal, said.

It also gave the city more control over what happens to properties that would otherwise fall into the hands of private bidders at auction.

The Housing and Preservation Department has rehabilitated more than 6,000 distressed apartments while keeping them affordable, according to a promotional video the city has on its website.

Some homeowners, however, are arguing that the program doesn’t do enough to make sure they know about their debts and what’s at stake, so it ends up costing them the very properties the program was created to protect.

Barron said New York is a different city now than it was 25 years ago.

“Neighborhoods once written off as irredeemable are now hotspots of gentrification,” he said.

At the recent hearing, Brooklyn Councilman Robert Cornegy said the city Department of Housing Preservation and Development hasn’t seized any properties in the majority-white Staten Island area.

The seizures are focused largely on properties in Cornegy’s historically Black district, the councilman told Crain’s New York.

“They are the highest gentrifying areas at this particular moment in history, and that can’t be a coincidence,” Cornegy said. “In minority communities, one of the only ways to build and transfer wealth is through the accumulation of equity in properties.”

Bronx Councilman Ritchie Torres said in the Crain’s article that those dispossessed in the transfer process received no compensation, despite the high value of their buildings — which are often worth far more than their overdue bills to the city.

“The ends do not justify the means,” he said. “The notion that the government can threaten to strip you of all your equity based on one cent in tax arrears is crazy.”

The Housing and Preservation Department says the debt threshold for the city to initiate transfers of property is at least $1,000 in city arrears for at least one year, or $1,000 for at least three years under the city’s Housing Development Fund Corporation program, the New York Daily News reported. But the city claims its focus is on properties that have a large amount of arrears, with the department saying the average amount of arrearage for properties slated for transfer is more than $900,000, numbers that advocates like Councilman Torres dispute