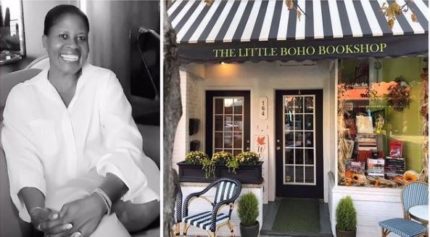

Tina Byles Williams is the founder and chief financial officer of Philadelphia-based FIS Group. (Image courtesy of FIS Group )

Philadelphia-based money management firm FIS Group is set to become one of the nation’s largest Black-owned investment companies after agreeing to acquire North Carolina–based Piedmont Investment Advisors LLC late last month.

Together, the firms carry a combined $10 billion in assets, The Philadelphia Inquirer reported.

Founded by the city’s onetime chief investment officer Tina Byles Williams, the 27-person FIS Group will remain in Philly while Piedmont, a 21-person firm that invests in the North Carolina State pension plan, will retain its name and operate as a wholly owned subsidiary, according to the newspaper. Piedmont employees will also be able to keep their jobs.

Ariel Investment Partners of Chicago currently sits on top as the U.S.’s largest Black-owned money manager, boasting nearly $13.1 billion in assets. FIS Group could soon give them a run for their money, however, now that they have Piedmont under their belt. The firm sells “manager of manager” investment funds and, like Piedmont, is primarily hired to manage government clients.

Moreover, both FIS and Piedmont are owned and operated by largely African-American staff. FIS said it currently manages around $5.6 billion in “innovative portfolio solutions across the global public equity spectrum through entrepreneurial managers worldwide.” Meanwhile, Piedmont said it’s projected to manage $4.7 billion in “active, passive, and structured beta equity and core fixed-income management” by June 30, The Inquirer reported.

Piedmont owner and CEO Isaac Green said he’s known Byles Willaims and FIS president McCullough Williams for decades and expressed excitement about their new partnership.

Our firms have “similar investment beliefs” and “client-centric, entrepreneurial, and innovative cultures,” Williams told the newspaper, adding that together, they’ll sell “a full complement of equity (active and passive), fixed income (active), U.S., non-U.S., and global strategies,” with stronger “investment capabilities, talent, technology, and resources.”

As for Byles Williams, the chief investment officer said she sees the merger as an opportunity to make FIS Group a “strong multi-asset management firm.”