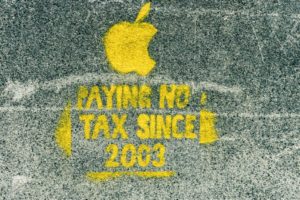

The Paradise Papers are 13 million leaked financial records from Appleby, a Bermuda-based law firm that helps the wealthy set up offshore corporations to avoid paying taxes. Tax havens are used to hide around $7.6 trillion worldwide. Apple has used tax havens in Ireland and Jersey to protect $252 billion in overseas cash from taxation in the United States. (Photo: Flickr)

The Paradise Papers detail perhaps one of the greatest economic injustices of which many have not heard, yet involve an economic issue that affects everyone.

The documents are 13 million leaked financial records from Appleby, a Bermuda-based law firm that helps the uberwealthy and corporations set up offshore corporations to avoid paying taxes. Founded in 1898 by Maj. Reginald Appleby, an anti-tax British officer, Appleby has offices in almost all of the global tax havens, including Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, Hong Kong, the Isle of Man, Jersey, Mauritius, the Seychelles and Shanghai. As The New York Times reported, these offices offer companies a post office box, low or zero tax rates, and accountants and lawyers who are well versed in hiding clients’ money.

Offshore finance is legal, and it is also problematic. These offshore tax havens — often established in scenic island locations, hence the name “paradise” — are the means by which heads of state, monarchs, politicians, celebrities, and the world’s largest companies hide and hoard their money and contribute to economic inequality around the world. Sounding much like a conspiracy theory yet very much grounded in reality, these havens are home to around $7.6 trillion — including 8 percent of the world’s household wealth —which is double the U.S. federal budget, and falls within the range of estimates for the cost of U.S. slavery reparations.

The German newspaper Süddeutsche Zeitung first obtained the papers, covering two offshore service firms in 19 jurisdictions, and shared them with the International Consortium of Investigative Journalists. These documents create a narrative of a worldwide oligarchy, a global elite ranging from the queen of England and Nike to Donald Trump’s cabinet and corporate giants who exploit the mineral wealth of the Congo.

President Trump has surrounded himself with people who use offshore tax havens to enrich themselves substantially. For example, U.S. Commerce Secretary Wilbur Ross has been one of Appleby’s biggest clients, with more than 50 partnerships and companies in the Cayman Islands. The Paradise Papers revealed Ross is a business partner with the son-in-law of Russian president Vladimir Putin through offshore investments in Navigator Holdings, a shipping company whose top customers include Sibur, a Russian energy company linked to the Kremlin. Ross, who retained his interests in Navigator after assuming office, stands to benefit from Russian interests that are subject to U.S. sanctions.

Two Russian firms tied to Putin made substantial investments in Facebook and Twitter through an investor with financial ties to Trump’s son-in-law Jared Kushner.

As Queen Elizabeth II received taxpayer revenue to maintain Buckingham Palace, her estate used a Cayman Islands fund to invest in BrightHouse, a British rent-to-own company criticized for bilking the poor and charging exploitative interest rates on household appliances — as high as 99.9 percent. The Universities of Cambridge and Oxford have secretly invested tens of millions of pounds in multibillion private equity partnerships in the Cayman Islands, including a deep-sea drilling and oil exploration joint venture.

Nike, the world’s largest sneaker company, used an obscure subsidiary in the Netherlands to amass $12.2 billion in offshore revenue, paying no taxes in the U.S. and a 2 percent tax rate outside of the United States.

Apple, the most profitable publicly traded company in the world, uses a tax haven to funnel $252 billion in overseas cash and avoid taxation in the United States. While the corporation used Ireland for years to hide its overseas profits, the company now uses Jersey, a British crown dependency located off the coast of Normandy, France.

These offshore tax havens also enable multinational corporations to exploit the natural resources of the African continent. Glencore PL – one of the largest mining and agriculture conglomerates in the world, and the largest commodity trader — acquired the Katanga copper mine in the Democratic Republic of Congo (DRC) for hundreds of millions of dollars less than its value and diverted the wealth of the central African nation offshore. While Glencore is ranked number 16 in the Fortune Global 500 list of the world’s largest companies, with revenue in excess of $170 billion, DRC is the poorest nation in the world, despite its abundance of natural resources.

In Burkina Faso, that country’s tax office fined a Glencore subsidiary after learning the corporation abused loopholes to avoid paying tens of millions of dollars in taxes in connection with a multimillion-dollar zinc mine it operates. In an example of “slavery in miniature,” the corporation moved money from one of the world’s poorest nations into Switzerland and fired mine workers for demanding higher wages, all while the community dominated by the mine complains of poverty and hunger.

The release of the Paradise Papers comes a year after President Obama called for international tax reform following the release of the Panama Papers — the 11.5 million documents from law Panama-based law firm and offshore service provider Mossack Fonseca. In 2016, Obama highlighted the scale of tax avoidance schemes by Fortune 500 corporations.

“There is no doubt that the problem of global tax avoidance generally is a huge problem,” Obama said in April 2016. “The problem is that a lot of this stuff is legal, not illegal.” Then-President Obama argued it should not be legal to engage in transactions simply to avoid taxes and praised “the basic principle of making sure everyone pays their fair share.” Obama added that many of these loopholes come at the expense of the middle class, as lost revenue must be made up somewhere. “Alternatively, it means that we’re not investing as much as we should in schools, in making college more affordable, in putting people back to work rebuilding our roads, our bridges, our infrastructure, creating more opportunities for our children,” he said.

The Republican tax plan would give corporations who hoard their wealth huge tax breaks, including many of the members of the global elite implicated in these documents. Seven Republican megadonors, who are worth an estimated $142 billion combined and include such magnates as Charles and David Koch and Sheldon Adelson, pumped $350 million into the 2016 election. If the GOP fails to pass “tax reform,” their revenue stream will run dry, some suggest. “The party fractures, most incumbents in 2018 will get a severe primary challenge, a lot of them will probably lose, the base will fracture, the financial contributions will stop, other than that it’ll be fine,” explained Sen. Lindsey Graham (R-S.C.).

The Paradise Papers have everything to do with economic inequality in the world and the discovery that with trillions of dollars unaccounted for and hidden from taxation inequality is even worse than previously realized. Meanwhile, what becomes of the untold wealth that could be helping society?