Sixty percent of white families invest in the stock market, compared to less than a third of Black families. (Image courtesy of Luxury News Online)

About 1 in 7 white families are now millionaires, that is nearly double the percentage of white families who are worth over $1 million compared to 1992, according to recent Federal Reserve data.

Rising from 7 percent to 15 percent in a quarter of a century, the rapid growth among white millionaires reflects the widening gap between the upper and middle-classes, as well as a deepening wealth disparity between white and nonwhite households. For instance, the percentage of Black and Latinx families worth more than $1 million has hovered around or below 2 percent since the Fed’s 1992 Survey of Consumer Finances.

“We have growing wealth disparities among whites as well, but the white group is so much further ahead that the class of elite Blacks is nowhere near the class of elite whites,” Darrick Hamilton, an economist at the New School in New York, told The Washington Post.

The newspaper’s analysis of the Fed data revealed that much of the growth in white wealth over the last two decades can be attributed to the doubling of financial assets like stocks and bonds, as well as pensions and retirement savings. Equity in their primary homes, along with equity in non-financial assets, like vacation homes and fine jewelry, saw growth as well.

In contrast, Black and Latinx households tend to lag when it comes to key indicators of wealth, including homeownership, equity, investments and inheritance. The Fed data showed that Black and Latinx families are less likely to own stocks and mutual funds than white families. Moreover, less than one-third of Black and Latino households are ever exposed to the stock market, compared to the 60 percent of white households who invest in stocks.

Homeownership is also a significant factor, as its the largest component of wealth for most U.S. families, The Washington Post reported. Almost three-quarters of white families already own their homes, while less than half of Black and Latinx families do. Even among homeowners, however, minority-owned homes tend to have lower values due to discriminatory practices like redlining.

“If you’re a Black homeowner, you are more likely to have a lower value on your home because of neighborhood segregation,” Valerie Wilson, director of the Economic Policy Institute’s program on race, ethnicity, and the economy, told the newspaper. “Blacks couldn’t purchase in white communities where values were rising faster.”

Lastly, Black and Latinx households are less likely pass down or inherit wealth from their families. According to the Fed data, one-quarter of white households said they received an inheritance, compared to just 8 percent of Blacks and 5 percent of Latinxs.

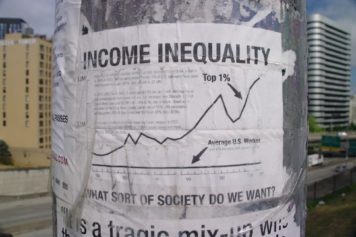

Some policy experts worry that the new GOP tax plan, unveiled last week, will only help the rich get richer and keep the poor poor. An analysis by the nonpartisan Urban-Brookings Tax Policy Center showed that the richest 1 percent of Americans would see major financial gains if the policy passed, further widening the wealth gap.

“The racial disparities in wealth, which is the paramount indicator of economic opportunity, security and overall well being, remain stark,” Hamilton said. “And if the Trump tax plan, which includes the elimination of the estate tax, is made into law, it will only get even larger.”