Black-owned businesses are an engine of growth in the U.S., and they must be supported. The United States is becoming an increasingly Black and Brown country, so it is incumbent upon the nation to offer more economic opportunity for those who traditionally have been left out of the process and who have been so used to having doors shut in their faces.

A recently released national survey reveals that Minority Business Enterprises encounter issues in securing access to capital. The National Minority Supplier Development Council — a corporate membership organization that promotes business opportunities for minority-owned businesses and connects them to corporations — issued the survey, which “focuses on the internal factors, those within a minority firm’s control, which may hamper their ability to obtain critical growth or acquisition capital.”

The NMSDC defines an MBE as a business that is at least 51 percent owned by minority group members. For publicly-owned companies, at least 51 percent of the stock is owned by one or more minority group members. NMSDC defines a minority as a U.S. citizen who is at least one-quarter Asian-Indian, Asian-Pacific, Black, Hispanic or Native American.

According to the survey, internal factors that impede an MBE’s access to venture and other institutional capital are: lack of a growth-oriented succession plan for business owners; a knowledge gap about sources of capital; the negative perception of venture capital among MBEs; few efforts to seek funding sources beyond traditional banks; and MBE certification requirements themselves.

NMSDC

“Our National Survey on Access to Capital highlights the need for initiatives, such as that announced in August by the Obama Administration and the National Venture Capital Association, to create a more inclusive environment for minority-owned business enterprises to identify and obtain capital funding,” said Joset Wright-Lacy, president of NMSDC. “We offer NMSDC National Survey on Access to Capital programs designed to provide tools and skills to educate minority business owners in the means and best practices of raising capital. The NMSDC network includes investors and financiers who are very interested in investing in our certified MBE firms.”

In August 2015, representatives of the largely white-male venture capitalist profession met with President Obama to advance opportunities for underrepresented groups and women in the entrepreneurial ecosystem. According to the White House, over 40 leading venture-capital firms managing more than $100 billion made commitments to such efforts, and institutional investors pledged over $11 billion to emerging managers.

NMSDC

As USA Today reported, a 2011 survey by the National Venture Capital Association and Dow Jones VentureSource found that 89 percent of investors were male, 87 percent were white and 11 percent were female. This lack of inclusion determines who receives funding, as entrepreneurs of color and women entrepreneurs are substantially less likely to raise venture capital than white men. Venture capital has a disproportionate effect on wealth creation and the nation’s economy, particularly for Silicon Valley, where it has funded giants such as Facebook and Google.

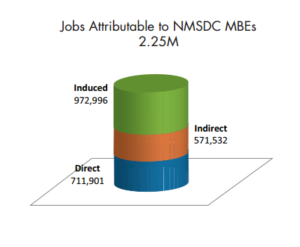

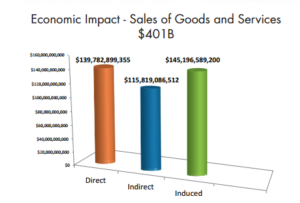

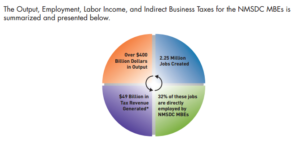

MBEs are fueling growth and employment in Black, Latino and other communities, leading to the recycling of dollars in the community, as NMSDC has emphasized. The economic impact of MBEs is substantial, with $400 billion in output each year — or over $1 billion per day — 2.2 million jobs, $138 billion in salaries and $49 billion in tax revenue.

NMSDC

We need to support these companies. It is important for corporations and institutions to use MBEs as vendors because it helps the Black community, and also because it is a matter of the nation’s economic future. In many industries, the minority business sector is the fastest-growing sector for small businesses, just as entrepreneurship and small-business ownership are the greatest engine of wealth and job creation in America.

“Improving access to capital among underrepresented minority entrepreneurs is more than a social issue,” the survey states. “It is an economic imperative.”

If state and federal governments do not support our businesses, they do so at their own economic peril.

NMSDC says education is crucial in improving access to capital among MBEs, including online and on-site methods to teach best practices for high-growth entrepreneurship and fundraising, and give businesses the necessary tools to boost their financial sophistication to deal with fund managers. The report also spoke to the need for more networking opportunities between minority entrepreneurs and those who provide the capital.