America has a bank problem, though maybe not the type you’d think. The problem is that there is a scarcity of banks in economically marginalized communities, which for our purposes refers specifically to Blacks, Latinos, Native Americans and other people of color.

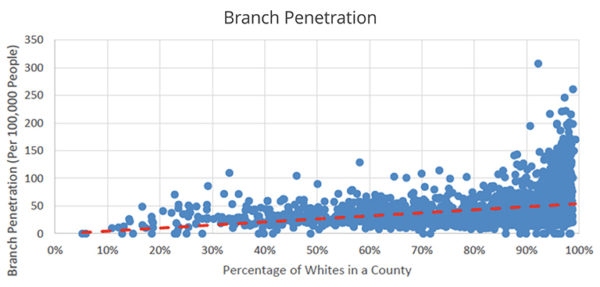

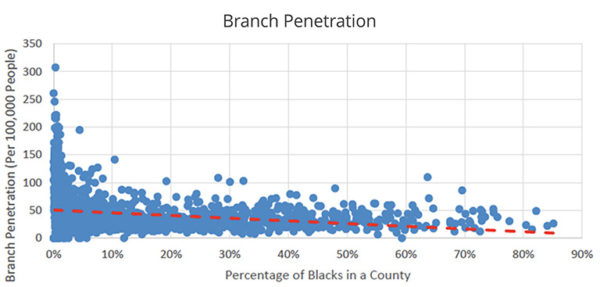

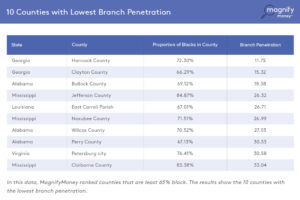

A new study from MagnifyMoney examined the concentration of banks and credit unions in counties throughout the United States. And what they found, based on Census data and FDIC and NCUA branch data, was a strong relationship between race and the presence of branches. To put it bluntly, the whiter the county, the greater the number of banks. The darker the community, the more likely it will be underserved by these financial institutions.

Just to unpack the data, the study found that in counties that are over 50 percent Black and Brown, there are 27.1 financial institutions for every 100,000 people. In contrast, in counties that are over 50 percent white, there are 40.6 banks for every 100,000 people, a marked difference based on the complexion of the neighborhood.

Predominantly Black communities have 32 branches per 100,000 people, while majority Latino areas have 22.51 branches. Meanwhile, Native Americans suffer from the lowest bank penetration at only 20.53 per 100,000.

To put all of this in perspective, overall the U.S. has a branch penetration of 36.28.

Why is all of this important?

“Bank branches can provide vital access to financial products for communities, including checking accounts and small-business loans,” said Nick Clements, a former banker turned consumer advocate, and founder of MagnifyMoney. “In the absence of branches, people often turn toward higher-cost services provided by check-cashing companies and payday lenders,” Clements added, with pawn shops also filling the void.

“Although bank branches are becoming less important with the rapid growth of digital banking and borrowing alternatives, they remain important fixtures in local communities and critical gateways toward lower cost financial products,” he said.

Clements also notes that having more bank branches is no guarantee that economically marginalized people will have access to the financial products they need. In addition, consumers with high credit scores do not need bank branches to avail themselves of these products.

Further, small businesses depend on banks for financing, with 48 percent of business owners using a major bank, and an additional 34 percent relying on a regional or community bank. Without a bank in the neighborhood, it is difficult for many small-business owners to gain access to working or growth capital.

MagnifyMoney notes there are alternatives. For example, digital and mobile technology — including Internet banking and the ability to make deposits from one’s cellphone — are replacing traditional banks, as are prepaid accounts. And some lenders are looking at loans that do not require FICO credit scores.

“However, traditional bank branches remain critical to small businesses that require affordable working or growth capital,” Clements says. “Minority communities have fewer bank branches. As a result, businesses that are owned and operated in minority communities with fewer branches will likely have less access to affordable capital.”

Moreover, the MagnifyMoney founder notes that there are numerous challenges facing economically marginalized folks out there. Approximately 56 percent of Americans have less than $1,000 in their combined checking and savings accounts, which means they live paycheck to paycheck and need quick access to cash. This is why check cashing places remain appealing, despite the fees people are required to pay. Finally, people will continue to seek out payday lenders in the absence of affordable, short-term credit options from banks.