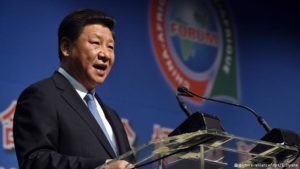

Chinese President Xi Jinping

The year 2015 was quite eventful for China-Africa diplomacy. Several high-level officials from both sides visited in each direction; the African Union and China signed a memorandum of understanding; China concluded an agreement to build a base in Djibouti; and China signed a host of bilateral agreements with African countries.

The capstone of the year’s diplomatic efforts was Forum on China-Africa Cooperation, hosted in Johannesburg on Dec. 4-5 and gathering delegations from 50 African countries, the African Union and China.

What did we learn about China-Africa relations from this meeting?

FOCAC’s launch was a collaboration among China and several African delegations to convene a triennial meeting that would chart out cooperation projects and discuss China-Africa relations multilaterally. At most of these meetings, ministers are the ones discussing policies and plans. When the Forum is called a summit, as this one was, presidents and heads of states are invited.

While this seems like boring bureaucratic terminology, it’s actually significant. Of the previous six FOCAC meetings, the only ones called a summit were in Beijing in 2006 and in Johannesburg. Indeed, this was the first summit-level meeting to be held on the African continent. Its success definitely earned South Africa bonus points, both among its African peers and also globally, as it showed that it can attract many heads of states and skillfully coordinate a summit.

China’s President Xi Jinping pledged $60 billion to African states. What does that mean exactly?

This isn’t aid in the traditional sense. Most of the announced $60 billion will come in loans and export credits. Only $5 billion is to arrive as grants and interest-free loans.

As others have previously explained in the Washington Post blog, Chinese aid differs from OECD-defined official development assistance and is often tangled with other financial commitments.

Right now, outsiders know very little about just how that committed $55 billion will be spent. China has announced the general outline of its commitments. For instance, $35 billion will go towards preferential loans, export credits, and concessional loans. Another $5 billion will go to the China-Africa Development Fund, a private equity and venture capital investment arm of the China Development Bank that has a lot of problems finding bankable projects.There’s $5 billion for the Special Loan for the Development of African SMEs, another financial vehicle implemented by the China Development Bank that operates on a commercial basis. Finally, $10 billion will create and offer the initial capital for the China-Africa production capacity cooperation fund, which might be an entirely new project — but we are not completely sure.

Announcements at FOCAC summits usually outline three years’ worth of money—but no dates were announced. Large figures like $60 billion require cautious analysis. It might not all be new capital. Often, the figure includes projects already initiated.

Finally, FOCAC’s financial goals are often reached well before the end of three years — or conversely, it may take longer than three years to allocate all the funding.

So China is investing a lot in Africa?

Not really. Most of these large China-Africa deals are carried out via loans financed by Chinese policy banks. They are not foreign direct investment, in which a company or entity from one country invests in another country’s company or entity, and has the foreign investor owning at least “10% of the voting power of the direct investment enterprise.” Unlike other investments, such as portfolio investments, FDI includes investors actively looking to influence how the enterprises are managed.

China recently announced that its cumulative foreign direct investment into Africa from 2000 to 2014 is $30 billion. As of 2012, China has been investing a little more than $2 billion annually into Africa.

That may be a lot — but it’s less than the U.S.’s annual investments in Africa. Furthermore, last year’s 40 percent drop in official Chinese investment in the first half of the year is not that significant because the base amount is low.

However, not all FDI is registered and catalogued with their respective government. For these unofficial flows, China is investing $6 billion in Africa compared to $8 billion from the U.S. These figures are tough to parse. Ministry of Commerce actually does try to release accurate data, but not every Chinese enterprise will register with MOFCOM.

It’s not clear whether China’s official accounting includes investments from Hong Kong and Macau, which have some autonomy from Beijing but often serve to channel both official and unofficial Chinese finance back into mainland China to take advantage of tax benefits, a process called round tripping. China invests less than 5 percent of its FDI stock, which is the cumulative level of FDI at any given time, in Africa, and exact figures are hard to pin down.

Read more at www.washingtonpost.com