A new study sheds more light on Baltimore and the racial and economic exploitation of its Black residents, particularly in the area of mortgage denials. According to Home Mortgage and Small Business Lending in Baltimore and Surrounding Areas, a report just released by the National Community Reinvestment Coalition, a consumer advocacy group, although Blacks are double the population of whites in Baltimore, banks gave mortgages to twice as many whites. And as it turns out, the racial composition of a neighborhood—as opposed to income– is the most important criteria in determining whether a loan is granted.

In light of the death of Freddie Gray by police this year, the unrest and protests and followed, and the underlying issues of racial injustice and economic disparities between Blacks and whites in that city, the new report is both timely and revealing.

“While many Americans take the ability to obtain a mortgage for granted, majority African American neighborhoods in Baltimore City are largely closed off from access to responsible credit and economic opportunity,” said NCRC President and CEO John Taylor in a statement. “These neighborhoods are lending deserts. This is part of a sad legacy of racial discrimination and segregation that continues to afflict the city.”

The key findings are as follows:

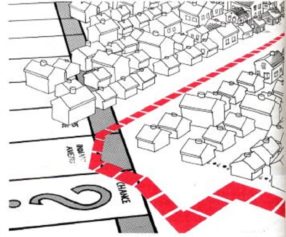

- The city of Baltimore and surrounding counties reflect different lending patterns, with disinvestment in the former, and affluence in the latter.

- In Baltimore City, race is paramount in mortgage lending, as there is more lending in whiter communities than in predominantly Black neighborhoods. However, in the surrounding suburbs, economic factors are the most useful in determining loan activity.

- Further, in the majority low-to-moderate income Baltimore City, it is difficult for borrowers in any income group to get approval for a mortgage. In wealthier neighborhoods in Baltimore County, low-to-moderate income applicants are more likely to receive a mortgage.

“Until our financial institutions make a full and genuine commitment that creditworthy borrowers, regardless of their skin color, will be able to access responsible credit, the economies in these neighborhoods will continue to deteriorate, and we will continue to have the circumstances you see in Baltimore, Ferguson, and elsewhere,” Taylor said.

In 2013, a mere 797 mortgages were made to Blacks in Baltimore, in a city with nearly 400,000 Black people. Meanwhile, 2,000 loans were approved for the city’s 175,000 whites. While 64 percent of more affluent borrowers were approved for mortgages in areas where the minority population was over 80 percent, higher-income borrowers had a loan approval rate of 82 percent where minorities were less than 10 percent of the population. Ultimately, Blacks receive 37 percent of the loans they should receive, and whites receive 210 percent based on what their population size would suggest.

When it comes to investment, banks are cherry picking communities and passing over Black areas. This redlining of Black neighborhoods leads to economic segregation, concentration of poverty (Baltimore is 25 percent impoverished) deteriorating neighborhoods and lower quality education and services.

As banks and wealthy financial institutions deny lending opportunities to Black Baltimore and helps to starve and hollow out these communities, financial vultures further exploit Black homeowners by seizing their homes. With struggling Black families already facing economic devastation, hedge funds are buying liens related to unpaid property taxes and water bills—sometimes as little as $250 or $500 in delinquent bills—and hiking the interest rates. When the homeowners are unable to pay, these hedge funds seize the properties. Thus far, they have taken millions of dollars worth of Black people’s property. This, in a city with as many as 46,800 vacant houses, with 30,000 homeless people in a given year, yet Black people are denied mortgages in a wholesale fashion.