Three ETFs offer minor exposure to Kenya:

Guggenheim Frontier Markets ETF (FRN), weighted 8% in Kenya

iShares MSCI Frontier 100 Index Fund (FM), 6%

Market Vectors Africa Index ETF (AFK), 3%

Mutual funds with exposure to the country include:

Wasatch Frontier Emerging Small Countries Fund (WAFMX), weighted 9% in Kenya

Nile Pan Africa Fund (NAFAX), 19%

T. Rowe Price Africa & Middle East Fund (TRAMX), 5%.

Dr. Moses Ikiara, managing director of KenInvest, makes a case for why you should invest in Kenya.

Ho: Why should U.S. investors consider venturing to Kenya in their portfolios?

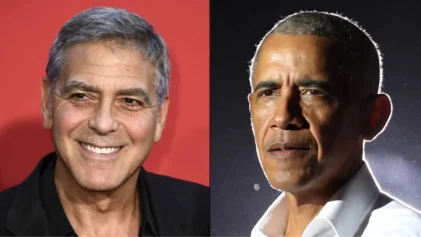

Ikiara: Quick, name the nation with the fastest-growing economy in Africa and third fastest in the world. The answer is Kenya, where President Obama made a three-day visit in July. It’s his first trip to his father’s birthplace since entering the White House. The trip coincided with Kenya’s hosting of the annual Global Entrepreneurial Summit.

Kenya, which Bloomberg predicts will be the world’s third-fastest growing economy in 2015, is an oasis of opportunity. Kenya’s location on the eastern coast of Sub-Saharan Africa positions it as the commercial gateway to the rest of Sub-Saharan Africa. It’s a destination for investors looking for exposure to East Africa and its 140 million consumers. The free-trade agreement that was signed in June between the East African Communities (EAC), Common Market for Eastern and Southern Africa (COMESA) and the South African Development Community (SADC) offers market access to 600 million consumers.

As the largest economy in the region, Kenya accounts for 40% of the East EAC’s gross domestic product and has the region’s best performing regional currency. Its nascent economy is bolstered by a highly educated, English-speaking and youthful workforce. Some 60% of Kenyans are 25-years old or younger.

Read more at forbes.com