The nation’s top 5 percent of wealthy African-Americans are being extremely cautious when it comes to investing their money compared to their white counterparts and differences between each demographic suggests that years of economic inequality could be to blame.

Wealthy white Americans are being much riskier when it comes to investing their money, and in recent years those risks have really paid off.

Wealthy Blacks, on the other hand, have not seen major returns on their investments, which are mostly isolated to real estate and savings bonds.

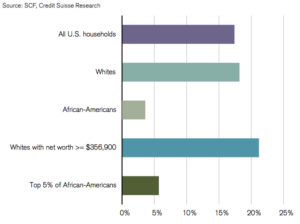

A study conducted by Credit Suisse in conjunction with the Institute on Assets and Social Policy at Brandeis University revealed that major differences between the nation’s wealthiest Black and wealthiest white Americans could explain why one group is willing to take more risks with their money.

A key difference was the amount of money each demographic had.

The top 5 percent of wealthy white people still made a significantly greater amount of money than the nation’s wealthiest Blacks.

The top 1 percent of the wealthiest whites alone made nearly six times more than the top 1 percent of the wealthiest Blacks.

Any investor will be more willing to make riskier investments if they have a larger amount of money. With the top percentages of wealthy whites making such staggering amounts of money, investments that could be incredibly risky for wealthy Blacks might not seem so intimidating to a white investor.

Statistics also revealed that many wealthy Blacks didn’t see much longevity in their financial success.

One in four African Americans who were in the top quartile of Black wealth holders in 1984 were no longer in that same quartile by the time 2004 came around.

Myths about the Black community convinced some people that African-Americans were simply poor business owners, but the report shed light on some of the real factors that are causing Black businesses to go under.

Black business owners were found to get approved for bank loans less often and those loans are usually of much smaller sizes with higher interest rates than whites who request the same loans with similar financial backgrounds.

With so many racist institutions taking aim at Black wealth, Credit Suisse’s chief marketing

“If you are in the top five percent and you are African-American you probably are smart to have a more cautious approach,” Thomas-Graham told the Washington Post. “Historically, there is more [downward] mobility, and fragility.”

It certainly makes risky investments seem exponentially more intimidating than they should be, but financial experts believe there is a lot of profit to be made by Black investors going out on a limb and taking that leap of faith.

Wealthy Blacks had much lower rates of investments in businesses, stocks and mutual funds when compared to whites.

That’s where most of the money is being made and it’s causing the wealth gap to continue to grow, the study suggests.

For every $1 the wealthy African Americans had, their white counterparts had nearly $8.

“It is possible people are not seeing the full range of options that are available,” Thomas-Graham said.

With the stock market soaring, investors believe now would be a great time for many wealthy Blacks to take those calculated risks and increase their wealth with high-reward investments.