Less than two weeks before the midterm election, there’s no doubt that the populace is angry and disenchanted, wondering if their country, their lives and their paychecks will continue a downward spiral with no end in sight. Much of the blame and the rage has been directed at President Barack Obama, but as Johnston shows in an important piece on Al Jazeera America, there is plenty of blame that also should be directed at the greed of corporate America and the unwillingness of Congress to invest in jobs through such initiatives like rebuilding the infrastructure and building up the education system, which would lift wages across the economy as corporate America would see profits rise and do more hiring.

Johnston used just-released data from the Social Security Administration to show why the public’s purchasing power has eroded, along with their confidence in Washington and corporate America to have their backs. The average American pay for 2013 was $43,041, which was $79 lower than the previous year and $508 lower than in 2007.

The government divides the average pay of workers into 60 different levels, ranging from $1 to $50 million. Johnston reports that the average pay declined in 59 of the 60 levels. The only group whose wages didn’t fall was people making over $50 million a year. The average pay of that group increased by $12.8 million, to $111.7 million, but their numbers decreased — from 166 people in 2012 to 110 people last year, which is a decrease of a third.

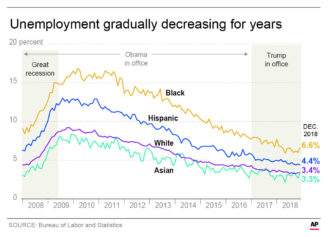

The SSA data showed there were 2.1 million more people working in 2013 than in 2012, which was close to the 2.4 million increase in the population, a positive trend. But over the last 13 years, the number of people working increased by 5.7 percent while the population increased by 12 percent. So although the unemployment rate dropped below 6 percent in September for the first time in six years as the economy added 248,000 jobs, there is still a serious job shortage in the country. That results in increased competition for jobs, decreasing wages and discouraging many people from even looking.

Johnston attributes the recent decline in corporate profits to the overall decline in the purchasing power of Americans. Simply put, when people make less money, they spend less money. So that lowers corporate profits, thus lowering wages and hiring — and revving up a vicious cycle.

“Better pay and more jobs would help remedy this, but congressional gridlock is holding back economic reforms as a minority of lawmakers blocks government investments that fuel economic growth — especially investments in basic research, education and infrastructure,” Johnston writes.

He also points out that the decline in unions in this country has lowered pay.

“While the United States’ major economic competitors Europe, Japan and Canada are heavily unionized, only about 1 in 15 American private sector workers is a member of a union,” Johnston says. “Employers are in such a powerful position at this point that it may be misleading to speak of a job market in the traditional sense of an open, competitive marketplace for labor. Instead we have created a one-sided market with take-it-or-leave-it pay for the vast majority of workers who lack unique talents.”

How is the pay of Americans distributed across the spectrum? Nearly two-fifths of jobs pay less than $20,000, almost three-fourths pay under $50,000, and 99 percent pay under $250,000.

For those Americans making $1 million to $50 million, the number of jobs dropped from 119,200 in 2012 to 113,000 last year, meaning about 1 in 20 such jobs vanished. The average pay in that group fell by $118,000 to an average of $2.3 million.

“We can do better than this,” writes Johnston, also a bestselling author. “We can elect leaders who favor broad prosperity through time-tested principles that encourage investment in economically productive activities rather than in financial speculation and unproductive assets such as mansions and yachts, that favor domestic jobs rather than offshoring, that restore bargaining power to workers and that recommend major new public investments that will make the economy more efficient and expand the knowledge base from which wealth creation springs.”