A House bill sitting in the Financial Services Committee could weaken a key mortgage reform that was intended to protect homebuyers from excessive fees during the process of obtaining a mortgage, according to consumer lending organizations.

According to the Center for Responsible Lending, the Dodd-Frank Wall Street Reform and Consumer Protection Act was designed to restrict risky mortgage features such as high origination fees, balloon payments and interest-only payments.

The House bill would, instead, exempt certain fees from percentage point and fee limits for loans that meet the definition of the so-called “qualified mortgage.” The change, according to the center, would result in more expensive loans from borrowers.

“H.R. 1077 would weaken the consumer protections of QM loans by legislating a group of exceptions to get around the 3 percent points and fees threshold,” according to a letter to Congress last week calling for the defeat of the bill, which was signed by dozens of local, state and groups, including the NAACP, the Leadership Conference on Civil and Human Rights, the NAACP Legal Defense and Educational Fund, Inc. (LDF) and the National Council of La Raza.

“These exceptions include exempting compensation paid to mortgage brokers and loan officers and title insurance paid to a company affiliated with a lender from counting toward the 3 percent cap.

“The approach taken in this bill, which is misleadingly named the Consumer Mortgage Choice Act, is a flashback to the recent subprime crisis. During the subprime lending boom, borrowers often paid excessive origination costs, and increased compensation paid to loan originators often fueled these high fees.”

The four-page bill, introduced in March, is a series of amendments to the language in the Dodd-Frank Truth in Lending Act “to improve upon the definitions provided for points and fees in connection with a mortgage transaction.”

Supporters said the bill is important because the Dodd-Frank reform legislation included items that did not belong in the calculation. The QM is expected to be less costly to consumers because it builds in many protections for both borrowers and has reduced lender risks.

The legislation was introduced by Rep. Bill Huizenga (R-Mich.) and had seven original cosponsors: Rep. Gregory Meeks (D-NY), Rep. William Lacy Clay (D- MO), Rep. David Scott (D-GA), Rep. Gary Peters (D-MI), Chairman Emeritus Spencer Bachus (R-AL), Rep. Edward Royce (R-CA), and Rep. Steve Stivers (R-OH).

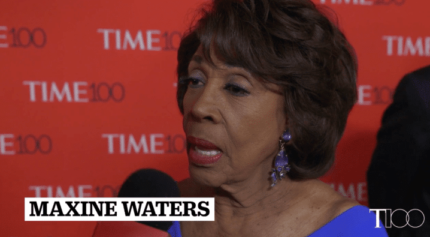

The bill now rests before the Financial Services Committee, chaired by Rep. Jeb Hensarling (R-Texas). Rep. Maxine Waters (D-Calif.) is the ranking Democrat on the panel.

The measure has support from the National Association of Federal Credit Unions (NAFCU), a trade association that represents the nation’s federal credit unions, the Mortgage Bankers Association and Americans for Prosperity, a conservative political advocacy group. They contend the bill would provide greater clarity and lower the chances that risky mortgages would be issued.

The center said separately on its website, however, that black and Latino borrowers were disproportionately targeted and harmed during the subprime scandal because they were steered into more expensive loans than they normally would have qualified for and that the exceptions proposed in the current House bill “would create a new kind of incentive for future abusive lending that overcharges consumers.”

Jackie Jones, a journalist and journalism educator, is director of the career transformation firm Jones Coaching LLC and author of “Taking Care of the Business of You: 7 Days to Getting Your Career on Track.”