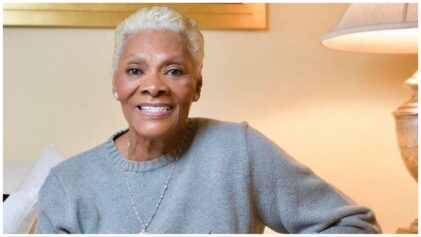

Dionne Warwick’s long and complicated relationship with the IRS is coming to a close.

On March 21st, the soul singer filed for Chapter 7 bankruptcy over tax liens dating back to the 1990s.

“Ms. Warwick had a business manager who mismanaged her affairs,” her attorney Daniel Stolz told Rolling Stone. “Before she knew it, she owed a gazillion dollars in taxes. She’s actually paid more than the face amount of the taxes, but with all of the crazy interest and penalties that they add, the number kept mushrooming – even though she paid off the amount that she owed in terms of the actual taxes.”

Warwick’s tax issues originated 15 years ago and have resurfaced often over the years, Stolz explains, even after the business manager in question was fired several years ago. He maintains that Warwick, 72, filed her taxes annually and was unable to work out an agreement with the IRS despite several attempts over the years – and that at one point, the IRS lost her file for several years.

Several outlets, including the Huffington Post, reported in 2009 that Warwick owed $2.2 million, but the IRS revoked that claim and corrected the amount to around $1 million. (Warwick also popped up along with actor Steven Seagal on a 2012 list of the Top 500 people and business owing the most in unpaid taxes in the State of California.)

While the singer continued to pay, that money was only applied to penalties and interest, not the principle amount; Stolz argues that Warwick paid close to $1.3 million, more than her actual lien.

“The taxes are of an age where under the bankruptcy code, they’re dischargeable taxes,” Stolz says. “We’ve found that we had no other resort other than to file bankruptcy so that we could get this off her back finally.”

Warwick just wrapped a string of tour dates in New York and New Jersey, including a benefit performance for the restoration of the Count Basie Theater in Red Bank, New Jersey. Warwick doesn’t perform often enough to pay for her growing tax lien; per her bankruptcy petition, Warwick’s average monthly income fell around $20,950.00 with $20,940.00 in expenses, leaving her with $10.00 net income (a figure that is not unusual for a celebrity after living costs and mortgages are factored in).

Stolz says the IRS is not giving Warwick a break because the organization is looking at the singer as a celebrity and “not by her capacity to pay.”

Read more: RollingStone