African-American new college graduates may face a harder challenge finding good paying jobs than their white counterparts. (Photo courtesy Pixabay/ellemclin)

The Class of 2017 is facing the strongest labor market in nearly 10 years. According to research from the Federal Reserve Bank of New York and the Rockefeller Foundation, the unemployment rate for recent graduates is at its lowest rate since October 2008. This has led some to suggest that this nation has finally emerged from the ravages of the Great Recession.

However, this may be a matter of perspective. According to the Bureau of Labor Statistics’ 2016 Household Data Annual Averages, African-Americans with some college but no degree have the same unemployment rate as whites with no high school diploma. While the ratio between Black and white unemployment rates decreases as the esteem of the earned degree increases, African-Americans — at no point — have parity with whites under similar circumstances.

When taken in consideration with research from the Federal Reserve that showed that the underemployment rate – or the rate of college graduates working jobs that do not require a college degree — has shown little change since the Great Recession, one must conclude that, while there have been gains, the labor market remains unfriendly for Black college graduates. A lack of quality-paying jobs and applicant discrimination continues to make finding the right job difficult if you are Black and young.

“Following the election of President Obama, Black people experienced a level of hope and possibility for parity previous generations never thought possible,” Andrew Ryan, CEO of MemberSuite, a provider of association management software, said. “In this time of hope, we also saw instances which clearly demonstrated we, as a country, are not as color blind as we thought. This showed up in all areas of society, including socioeconomics.

“While there’s been enormous progress, people of color continue to lag behind white people in income and wealth accumulation.”

Wages and the Meaning of a Job

To understand what is going on in the Black community, it is important to look at the national job numbers first. Across the board, unemployment levels are at or near pre-recession numbers. April’s unemployment rate of 4.4 percent is the lowest rate since May 2007, continuing a 13-month string of progressively lower rates. While April’s addition of 156,000 jobs is on the anemic side — considering recent history — it is growth.

Underemployment, however, has been stagnant at approximately 42 percent, give or take five percent, for the past 20 years. When all college graduate are factored in, this creates a situation where one-third of all American college graduates have a college degree that they do not use.

“Entering the labor market in a severe recession can lead to reduced earnings for as many as 10 to 15 years,” the Economic Policy Institute wrote in its “The State of Working America” series. “Young workers at all levels of educational attainment who enter the labor market during a downturn face higher rates of unemployment. In addition, because of the scarcity of available jobs, these young workers are less likely to land a stable entry-level position that will lead to advancement and are more likely to experience a lengthy period of instability in employment and earnings.”

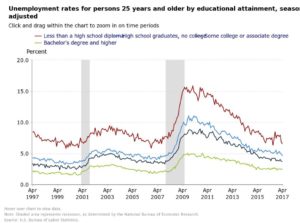

A deeper dive into the numbers shows what may be behind the nation’s declining unemployment numbers. A look at the BLS’s unemployment rates for persons 25 years and older shows that the unemployment rate for bachelor’s-degree holders has

(Courtesy the U.S. Bureau of Labor Statistics)

not changed since June 2015, while rates for workers with high school diplomas or with some college show marginal gains. It is with workers with less than a high school diploma that a significant employment spike is seen, with the unemployment rate dropping from 8.1 percent to 6.5 percent since June 2015.

This reality presents a tough challenge for the president, who has made job creation a priority for his administration. These numbers represent a structural change in America’s job market that may be impossible to fix with fiscal policies.

Some of this could be attributed to a critical flaw in recruitment strategies for sourcing hiring candidates. These underemployment figures are occurring at a time that job openings are on the rise. One argument is that the fount of the nations’ new job creation — small and middle-sized businesses, which have been responsible for 70 percent of all new job creation since 2015 — are not reaching out enough to the new graduate class. Many of these businesses cannot perform outreach to these graduates due to economic scale or lack of resources.

Another argument to explain the persistent underemployment problem is the degree trap. In this scenario, employers select new graduates for their companies not based on the skills they have or their ability to do the job, but primarily on the prestige of their degree. This creates a situation where well-skilled, non-degree holders and graduates of less prestigious colleges are excluded from hiring consideration.

This creates an artificially small talent pool. Research from the Rockefeller Foundation found that this situation is so acute that 63 percent of all executive recruiters indicated that they would be open to considering someone without relevant previous experience, compared to the 60 percent of the same group that said they would consider someone without a college degree.

Job Attainment in the Black Community

When you add race on top of all of this, things go askew. “While we are close to 2007 employment numbers, African-Americans are still quite a way from full employment,” Valerie Wilson, director of the Program on Race, Ethnicity and the Economy at the Economic Policy Institute, said. Wilson pointed out that if one was to look at the employment-to-population ratio for African-Americans, which is the percentage of African-Americans who are actively working, it is still below 2007 numbers.

This reflects an underreported truth about the Great Recession and African-Americans. Due to the foreclosure crisis and the fact that Black wealth is more likely to be materially stored in the equity of a home than in bank instruments, the Great Recession served to wipe out African-American household wealth. Per the Institute for Policy Studies, if economic trends were to stay the same as today, it would take the average Black family 228 years to accumulate the same amount of wealth a white family has today.

In reality, African-Americans have yet to emerge from the Great Recession. One of the reasons for this is the bleeding of the nation’s construction, manufacturing and public sector jobs. Many of these positions were unionized, allowing African-Americans ready access to higher-paying jobs with better benefits. With the recovery of these jobs slowed or stalled, many African-Americans have been forced to work in lower-paying, less-protected jobs or to leave the workforce altogether.

With wage growth being either stagnant or in free fall for African-Americans since the mid-1990s, the lack of quality jobs has affected the economic mobility of African-Americans. As it stands today, three-quarters of all African-Americans born to lower-income households maintain lower-income households when they become adults.

Another factor is discrimination in hiring. “The job market today is better than what it was four or five years ago. Having said that, there are disparities in job levels for African-Americans across all education levels. African-Americans simply have higher unemployment levels than whites, and racial preference in hiring plays a role in that,” Wilson added.

Solving the Problem

Wilson felt that a way out of this “employment death spiral” is through Federal Reserve intervention. By delaying raising the interest rate, the economy can grow and continue to add jobs. The more openings that are available, the less hiring preferences can viably play a role in staffing.

“In a healthy economy, applicants that would otherwise be ignored in a weak economy would be considered,” Wilson said. “This is essential, considering the historical disparities for African-Americans in wages and job attainment. A healthy economy is one where African-Americans benefit financially.”

However, as previously pointed out, it is impossible to hire an applicant if the employer does not even know he is there. While fiscal policy can play a role in resolving the Black employment problem, another part of the solution may be closer to home.

“As an entrepreneur, I believe one of the surest ways to overcome pay disparities and lack of opportunities is to create our own,” Ryan added. “Black children need to get this message young and they need to hear it often.”

Due in large part to urban gentrification and unfavorable lending conditions, Black entrepreneurship took a hit during the Great Recession. One way forward is to promote the creation of Black enterprises that are local to the Black community. While creating jobs for new Black workers is essential, the larger goal is finding a way to invest wealth into the Black community. Only then can the disparities that challenge African-Americans be addressed and rectified.

Ryan added that “Creating your own business also means you’re more in control of your own destiny when downturns occur and removes the “last hired/first fired” reality from our mix,” Entrepreneurship will happen as more of us take this path, open up networking doors for young business-minded people and venture capitalists look to fund smart ideas and people – regardless of color.”