In startling testimony before the Senate Judiciary Committee Wednesday, Attorney General admitted he is concerned that the nation’s largest financial institutions were too big to prosecute..

When the world economy crashed in 2008 because of the malfeasance of some of America’s largest banks, many financial experts wondered if those institutions had gotten too big for them to be held fully responsible by law for their misdeeds. Holder, for the first time, confirmed that could be the case.

“I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy,” Holder said, according to The Hill. “And I think that is a function of the fact that some of these institutions have become too large.”

The concern came on the heels of attacks from lawmakers about the Justice Department’s failure to prosecute banks not only for complex cases involving the financial crisis, but also for cases in which proof wasn’t as hard to find, such as in the case of HSBC.

“It’s another glaring example that ‘too big to fail’ is alive and well,” Sen. David Vitter, R-La., who is co-authoring legislation to break up the big banks, said in an interview with American Banker. “If megabanks have a decided, quantifiable market advantage on the order of $83 billion a year, and if megabanks are so big the Justice Department, as enunciated today, will think twice and three and five and ten times about prosecuting them in a way they never would for other institutions, I think the American people’s reaction to that is, these banks are not just ‘too big to fail’ or ‘too big to prosecute’ — the bottom line is they’re just too big.”

Sen. Sherrod Brown, D-Ohio, who is co-authoring the bill with Vitter, sent out a tweet saying he was “shocked by AG Holder’s statement that megabanks are too big to jail.”

“Laws should apply equally to Ohio community banks and Wall Street,” Brown wrote.

There was agreement that Holder’s position will help Vitter’s and Brown’s cause.

“This adds fuel to that fire,” said Mark Calabria, director of financial regulation studies at the Cato Institute. “I’m surprised he admitted that DOJ has been pulling their punches, which to me is a shocking admission. There’s no ambiguity here.”

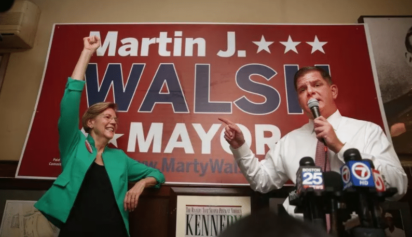

Massachusetts Sen. Elizabeth Warren, an expert on Wall Street reform, made a similar point during her first Senate Banking Committee hearing.

“There are district attorneys and U.S. attorneys who are out there every day squeezing ordinary citizens on sometimes very thin grounds, and taking them to trial in order to make an example, as they put it,” said Warren. “I’m really concerned that ‘too big to fail’ has become ‘too big for trial.’ That just seems wrong to me.”