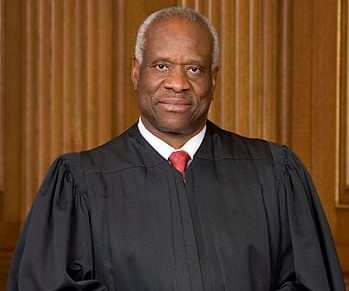

A new investigation has revealed that not only did billionaire GOP donor Harlan Crow shower Supreme Justice Clarence Thomas with gifts and treat him to luxury vacations, but he also potentially used the trips to save on his tax bill.

Crow is under investigation for potential violations of federal tax laws as Congress examines his lavish gifts and luxury vacations provided to Thomas.

The new report published by ProPublica on July 17 indicates the billionaire may have used the trips to skirt tax rules, making Thomas the butt of Twitter jokes once again.

Some memes liken the Black Supreme Court justice to a raccoon, symbolic of the term “coon,” which in this context classifies Thomas as a “sellout” to his race.

In April, ProPublica reported on Crow’s extensive gift-giving to Thomas over a span of two decades, including luxurious trips on Crow’s private jet and yacht.

The Senate Finance Committee is now questioning whether Crow properly reported these trips as taxable gifts to the IRS.

Operating a yacht as a for-profit business typically requires regularly chartering the vessel to third parties at fair market value. However, interviews with former crew members of Crow’s yacht, the Michaela Rose, reveal that it was primarily used by Crow’s family, friends, executives, and their guests.

Crow’s attorney, Michael Bopp, said that Crow leased the yacht from his own family entities for personal use. The question remains regarding who paid when others used the vessel and how the charter rates were determined, according to ProPublica.

Each year, gifts exceeding a certain threshold require a gift tax return. It is possible that Crow should have reported and potentially paid taxes on the value of the trips given to Thomas. However, Crow argues that the gift tax was designed to prevent estate tax avoidance, and since he retained ownership of his jet and yacht after hosting Thomas, he believes no gift tax is owed to the government.

However, tax experts suggest that luxury trips like those provided to Thomas should be treated as gifts and filed accordingly.

The Senate Judiciary Committee is also investigating Crow and Thomas’ relationship. This scrutiny has led to increased attention to the Supreme Court’s ethical standards.

The judiciary committee is set to review legislation this week that aims to impose ethics requirements on the Supreme Court. Justices currently do not have to adhere to a code of ethics like their counterparts in lower federal courts.

In addition to the trips, Crow also paid for Thomas’ mother’s home and his grandnephew’s private school tuition. He once gave Thomas a $19,000 Bible and gave his wife $500,000 to start a tea party group.

Thomas’ ethical practices also come into question because companies linked to Crow had business before the court.