A shaky economy has left hundreds of thousands of families facing foreclosure, but it seems that some of them may have actually been victims of illegal practices by Ocwen.

Benjamin Lawsky, one of New York’s top financial regulators, has been investigating the company and has already turned up some rather troubling findings.

According to NPR, investigations have already revealed thousands of back-dated letters that made it seem as if homeowners were late on payments and missed their window to avoid foreclosure.

While Ocwen claims they are willing to work with the regulators to fix the issues with the letters, another serious problem has already surfaced.

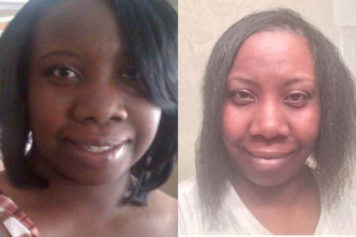

One of the lawsuit’s plaintiffs, Phyllis Nugent, said Ocwen has continued to slide mystery charges on her bill.

“They just keep sending us bills with erroneous amounts on there and then charging us all these different fees,” Nugent said.

Nugent, who lives with Chad Hopkins and her two children, said that Ocwen is now insisting she owes more money than what she borrowed years ago.

Despite making monthly payments on her mortgage for 10 years, Nugent’s balance stands at a staggering $150,000. She only borrowed $98,000.

“They charged us for property preservation,” Nugent said although the couple has clearly still been living in the home and caring for it.

In fact, Hopkins added that they have spent years renovating the home.

By the time all the mystery fees were added to one bill, the amount came to $18,000.

The couple didn’t have that much money to hand over.

Hopkins couldn’t describe the mystery fees as anything other than “robbery.”

“It’s robbery,” Hopkins said. “Every day you think about…am I going to have to pack up my stuff and lose all this investment? When you have small children and stuff, this is the only home they’ve ever known.”

To make matters worse, the couple was also forced to pay for insurance through a second company.

As it turns out, Ocwen has been “improperly steering profits to itself” through the affiliated insurance company that it forced the couple to make payments through.

After making several calls to the company to voice their concerns and get to the bottom of the tacked on fees, the couple has only been able to reach a call center in India.

The only advice they had for the couple was to just go ahead and pay the bill.

That seems like a difficult task considering one of the couple’s monthly statements has hit $73,000.

“We still get bills saying we owe outrageous amounts,” Hopkins said.

In addition to more bills, the couple has also been receiving foreclosure notices.

“Oh, yeah, they’ve sent foreclosure notices and they’ve filed here at the federal courthouse in Peoria, Ill.”

Meanwhile, Hopkins just hopes families across the nation will no longer have to face the same issues he and Nugent have had to face.

“[It’s] very frustrating,” Hopkins said. “And I know if it’s happening to us, I know it’s gotta be happening to other people.”

Ocwen’s chairmen said the company is “creating a review and remediation process for borrowers potentially impacted by the letter-dating mistake the company has made.”’

As for all those mystery fees and the suspicious secondary insurance company, Ocwen released a public statement insisting the company is “currently reviewing the lawsuit and will vigorously defend itself against the claims asserted.”