It turns out that income inequality, an issue that damages African-Americans more than any other group, is also slowly destroying state budgets across the U.S.

Whiles states are facing dropping revenue derived from income taxes because income for most people has been stagnant for decades, the wealthy manage to shield much of their income from taxes while also spending a lower percentage of their income. This results in what Al Jazeera America called a “double-whammy” for states.

“Rising income inequality is not just a social issue,” said Gabriel Petek, the credit analyst who wrote a report for Standard & Poor’s that was released Monday. “It presents a very significant set of challenges for the policymakers.”

The challenge for state governments becomes how to balance their budgets, as required under state laws — Do they raise taxes or cut services? Most states choose the latter, slashing spending for education, infrastructure and social programs — thus slamming marginalized groups like African-Americans once again, as they rely heavily on public schools to lift themselves out of poverty, infrastructure spending for jobs and social programs for the safety net needed when these other areas are deficient.

The income inequality that is slamming state governments is born increasingly by African-Americans. A comprehensive 2013 study by the Institute on Assets and Social Policy at Brandeis University found that the median wealth of white families in 2009 was $113,149, compared to $6,325 for Latino families and just $5,677 for Black families. Researchers at Brandies traced the wealth of 1,700 families from 1984 to 2009 and found that over that 25-year period, the total wealth gap between white and African-American families nearly tripled, increasing from $85,000 in 1984 to $236,500 in 2009.

The total impact of this gap can’t be overemphasized. A family’s wealth affects every aspect of that family’s life: dictating the quality of the neighborhood the family can live in, which affects the quality of the schools the children attend, which affects the likelihood the children will attain a college degree, which affects the family income and wealth all over again in an unending cycle. It also gives the family a financial cushion in case of emergency or job loss, which affects the stress in the household, which impacts the likeliness of a couple being able to weather the storms and stay together.

White families already earn about $2 for every $1 that a Black and Hispanic family earns, according to a study by the Urban Institute. The Great Recession made the gap infinitely worse, with Hispanic families losing 44 percent of their wealth between 2007 and 2010 and Black families losing 31 percent.

In comparison, white families lost 11 percent of their wealth.

State governments make matters even worse when they try to lure big business to their states by offering extremely low tax rates — thus depriving the state of even more much-needed tax revenue.

“If you’ve got political pressure to spend more money and pressure against raising taxes, then you’re in a pickle,” David Brunori, a public policy professor at George Washington University, told Al Jazeera America.

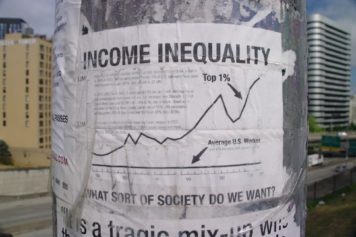

The median household income for Americans rose by just a few thousand dollars since 1979 to $51,017 in 2012, but the top 1 percent incomes averaged $1.26 million in 2012, up from $466,302 in 1979, according IRS data.

Another hit to state revenues is the fact that most people have switched to making a large percentage of their purchases online, thus avoiding state taxes.