A Florida nonprofit law group has announced it is helping an 80-year-old civil rights activist who is at risk of losing his longtime home.

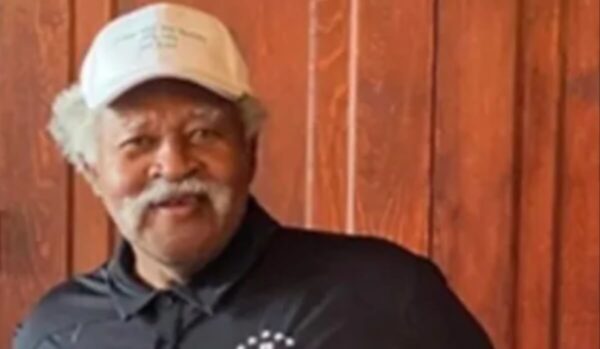

Arthur Johnson, 80, owns an aluminum-sided, two-bedroom home in Riverside, a neighborhood in Jacksonville. His ties to the area stem from his childhood, when his father would take him and his siblings to a local ice cream shop.

Now his home, which he purchased in 1986, is in jeopardy because of financial struggles, Jacksonville Area Legal Aid (JALA) said in a news release. Johnson has not been able to work while dealing with prostate cancer and other health issues.

Johnson serves as the director of First Tee-North Florida, a program that integrates golf and life lessons for children. He is a notable athlete who will be inducted into the African American Golfers Hall of Fame later this year.

Johnson attended Professional Golfers’ Association Tour qualifier school during his career, per JALA. In addition, he participated in the United Golfers Association Tour in the ’70s and ’80s.

Johnson’s activism also had an impact. He was involved in notable demonstrations, including those connected to the Monson Motor Lodge protest in 1964. The St. Augustine, Florida, lodge owner poured acid into the pool occupied by both Black and white protesters fighting against the establishment’s whites-only policy, according to NPR.

“The Black Golf Hall of Fame inductee has spent his lifetime making our community a better place for all of us to live in,” reads a GoFundMe created for Johnson. “Let’s help him save his Riverside home.”

The fundraiser launched Feb. 20 and has raised just over $1,300. It hopes to reach a $140,000 goal.

Johnson’s troubles started when he took out a reverse mortgage loan, accepting $24,000. However, he landed in hot water because he was only getting about $941 in monthly Social Security payments and struggling to repair his humble abode.

“Unable to get insurance, he defaulted on his reverse mortgage. After fighting to hold onto his home for 12 years, he ended up owing a total of $140,000 to pay off the mortgage,” the JALA said.

According to the law firm, reverse mortgages could be risky due to potential changes to the loan requirements. Black people and other minorities are most vulnerable, Johnson said.

“The amount of Black people that have lost their property is incredible,” Johnson continued. “It’s a good program, but you’ve got to stay on top of your responsibility to pay your taxes and insurance. As you get older, you’re not going to be able to keep up with that.”

Johnson, who was also a concert promoter, had invested a significant amount of his savings in Rowe Entertainment v. William Morris, a lawsuit aimed at eradicating discrimination in the music business, per JALA. Attorney Lynn Drysdale and housing counselor Marissa Vetter have been helping Johnson with his case to prevent foreclosure.

Vetter obtained a grant to reduce his balance and minimize his payments. According to the news release, the firm is optimistic that if everything works out they could temporarily save his property.

“These people, not knowing me from a can of paint, came in and just changed my whole life. They’ve been a tremendous help to me,” Johnson said. “They’ve dotted all the i’s and crossed all the t’s and given me a road map for how to structure it so that I’ll be able to save the property.”