Two recent technologies, blockchain and cryptocurrency, have the potential to do to the global industrial banking complex what iTunes and Spotify did to the music industry.

Cryptocurrency can be defined as any form of digital currency in which encryption is used to regulate the generation of units of currency and to verify the transfer of funds. By definition, cryptocurrency works independently of any central bank. The most popular cryptocurrency to emerge thus far is the wildly successful bitcoin. Blockchain is a distributed digital ledger system that tracks cryptocurrency transactions chronologically and publicly.

The net result is the ability to send and receive currency, free of the established financial infrastructure, thereby reducing the cost of transferring money between parties efficiently and inexpensively. And because distributed validation requires no physical infrastructure to transact, any individual with a bitcoin wallet — freely available to anyone with a smartphone — can immediately transact using the bitcoin cryptocurrency in conjunction with blockchain.

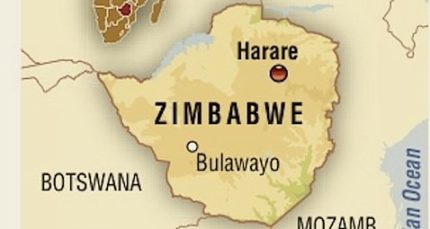

A Zimbabwe-based startup by the name of BitMari has established itself as the only Bitcoin wallet featuring multiple indigenous African languages, as well as development teams originally from the African continent. Zimbabwe has the highest literacy rate among African nations, and while 70 percent of the adult population has no access to traditional banking services, 95 percent have cellphones.

BitMari made history earlier this year when it partnered with Agricultural Bank of Zimbabwe, also known as Agribank, to integrate bitcoin and blockchain into the bank’s consumer offerings. As part of this partnership, BitMari will keep a float of United States dollars for Agribank, enabling their customers to remit funds received in bitcoin for United States dollars.

Zimbabwe did away with its national currency, the Zimbabwean dollar, following the hyperinflation that lead to the collapse of the Zimbabwean economy in the mid- to late-2000s. To stabilize the economy, Zimbabwe shifted to an international monetary system that replaced the worthless Zimbabwe dollar with the simultaneous use of multiple, more stable global currencies, the United States dollar, the South African rand, the Botswana puma, the euro, the Indian rupee, and the Japanese yen among them. Under Zimbabwe’s international monetary system, it is perfectly legal to conduct business in any combination of these currencies; you can literally make a purchase in yen and receive your change in puma.

While the international monetary system established a stable currency set, it also made transacting complex, particularly at the international level where exchange rates must be taken into account.

To complicate matters even further, this past November the Bank of Zimbabwe again began issuing a national currency in the form of “bond notes.” These notes are widely regarded as worthless; even local businesses are refusing to accept them as currency.

By maintaining a local supply of United States dollars on behalf of Agribank, BitMari is able to ensure that Agribank customers can receive bitcoin from anywhere in the world and remit it for United States dollars at Agribank. The end result is a Zimbabwean population with increasingly easy access to one of the most stable and widely accepted currencies in the world.

“Blockchain technology will allow Agribank and future indigenous African banks to leapfrog traditional remittance methods,” explained BitMari co-founder Sinclair Skinner. “Financial inclusion creates empowerment and ultimately stronger economies.”

Michael Maliner is a mixed-race writer who writes about race, culture and identity. Give him a shout on Twitter @PlasticSpoon.