For a number of countries, 2016 will be a make or break year. This is relevant both politically and economically. 2015 saw a number of major events that will ultimately shape the coming year in Africa — none bigger than the election of John Magufuli as president in Tanzania; the emergence of Macky Sall in Senegal as a legitimate democratic leader; and the desire of Pierre Nkurunziza to stay in power in Burundi.

Major economic issues, such as the dramatic decrease in petroleum prices and the recent slowdown of the Chinese economy, will play a major role throughout the region. Based on analysis and discussions with people in government, politics and business, below are my predictions for Africa’s top five countries on the rise, top four on the decline and top three on the bubble.

Top 5 on the Rise

Tanzania

2015 saw a number of great opportunities presented to Tanzania, and 2016 appears to be when many of these projects will begin to come to fruition. With large gas reserves off the coast, and major ports in Mtwara and Bagamoyo receiving funding and support, Tanzania is on the rise. The new president, John Magufuli, will play a great role in shaping this development. Magufuli took office with a no-holds-barred fight against corruption, so Tanzania’s infrastructure projects could move ahead rapidly and not get bogged down by the usual inefficiency associated with bureaucratic corruption. With a GDP of 7.4%, that continues to perform, 2016 may very well be the year that Tanzania officially takes the lead as East Africa’s leading economy and most-desired investment location.

Morocco

While Morocco is an obvious candidate as a rising nation, its status as one of the few North African — and even Arab nations — with a healthy economy and no major political problems will make the nation a more desirable investment destination for MENA-focused (Middle East North Africa) funds. The nation has a healthy economy that is not petroleum-based, and King Muhammed VI enjoys widespread popularity. According to the International Money Fund, Morocco’s economy grew by 4.4%, and this rate is expected to continue for the coming years. In 2016, more positive attention will be turned towards Morocco and their role in maintaining a balance between Islam, politics and a capitalist economy that provides socialist benefits for the people.

Rwanda

The big news for Rwanda was that its people voted to extend presidential terms. This will effectively allow Paul Kagame to run for office again, in an election that he will almost surely win. While Western observers and analysts have criticized the push for an additional term, most African observers generally support this idea because of Rwanda’s history and Kagame’s ability to transform the economy into one of the most robust in the region and developing world. The biggest problem facing Rwanda isn’t within its borders but rather the current turmoil in Burundi, which could easily spill over into their nation. Economically and politically, Rwanda is on track, and with the World Bank estimating a 7.5% growth rate, expect employment to increase and investment to flourish. If Kagame and other regional leaders can provide a tangible solution for the situation in Burundi, Rwanda will continue to be a key investment and development location in 2016.

Senegal

While the IMF has predicted Senegal’s economic growth rate to increase to 6%, the real story in Senegal will be the emergence of a viable political system that respects democratic values and ensures that future leaders do not become autocratic. With a strong political system and a growing economy, investors and developers will begin to focus more on initiatives in Senegal. The country’s system was put on display during the Ebola crisis of 2015. Only one reported case of the outbreak was noted, even though Senegal borders Guinea, one of the nations most affected by the disease. 2016 should signal Senegal’s emergence as one of the most politically and economically stable nations in West Africa, and this will further attract investment. In the petroleum sector, Senegal does have potentially large reserves offshore; however, the fall in oil prices may be a blessing in disguise. It will allow the nation to develop a more diverse economy and a more representative political system, minus petrodollars. When new official reserves are announced, the nation may have the right system and people in place to benefit in the long term.

Botswana

Politically, Botswana has a tremendous opportunity that even highly industrialized nations seek: a president with general popular appeal and his party, Botswana Democratic Party, holding the majority in parliament. Prudent financial planning has allowed the country to weather the storm of low commodity prices and diversify the economy’s non-mining sector. With low interest rates and an A2 credit rating by Moody’s, the government will seek to further enhance opportunities in multiple sectors outside of mining. An important factor in sustainable growth will be in human development, for which Botswana is ranked 3rd by the Mo Ibrahim Index. This will be reflected in the government’s emphasis on unemployment, which officially stands at 17.6% but is likely higher. 2016 should be a great year for Botswana because of a 2015 growth rate of close to 5%, lower unemployment, increased investment in various sectors and a political situation that is set for the next few years.

4 Nations on the Decline

Angola

For the past seven years, Angola has shown high levels of growth due to heavy investment in the petroleum sector. During this time, the capital, Luanda, has frequently been listed as one of the most expensive cities in the world because of the high costs associated with importing goods and the cost of services for the sizable expat population, associated with the petroleum sector. However, with oil prices having decreased by over 60% in the past 12 months and the central government’s lack of investment in other regions of the country during the oil peek, expect more internal pressure in the form of opposition politicians and nascent rebel groups across the nation. In addition, difficulties in 2016 may also be due to the economic slowdown in Brazil, which has been one of Angola’s strategic partners for development and investment. The coming year may show that unmitigated corruption in an oil economy and lack of economic distribution will be a curse for Angola and other nations with similar problems.

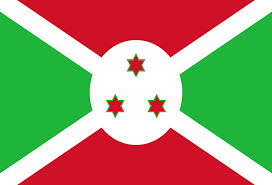

Burundi

With a similar mix of Hutu-Tutsi, despotic leadership and acute poverty, Burundi can become this generation’s Rwanda conflict. With President Pierre Nkrunziza’s refusal to leave office and his subsequent push to change the law to provide him with a level of legitimacy, this conflict risks turning into an open civil war. There have already been numerous coup attempts and various violent eruptions. Plus, the fact that the president refuses to allow African Union peacekeepers into the nation means this has the hallmarks of a disaster. Regional leaders are keen to have Nkrunziza removed but are reluctant to get directly involved, for fear of reigniting tensions from the former Great African War in the Eastern Congo/Rwanda/ Burundi/Southern Uganda regions. As things stand, the situation in Burundi will get far worse before it gets better.

Uganda

Uganda will be a curious nation to observe in 2016. On the surface, it has enjoyed long-term relative stability and has attracted foreign direct investment in the past few years. But there are a number of major issues below the surface that could turn the nation upside down. These issues start and begin with long-time president Yoweri Museveni. Since coming into power in 1986, he has essentially ruled the nation with an iron fist. He has maintained a policy of imprisoning opposition members and tactfully supporting his allies in politics and business. However, 2016 represents the first legitimate challenge to his authority and this, coupled with low commodity prices and the likelihood that China will slow the pace of infrastructure projects, means Museveni will not have the support he once enjoyed. And while this same dynamic is happening in various parts of Africa, Museveni does not plan to leave quietly. While a violent conflict may not be in the cards, expect a long, drawn-out political stalemate that will cause widespread confusion, a panic in the marketplace and a massive decrease in the value of the Ugandan shilling.

Libya

This is a rather obvious selection, but Libya’s worst days are yet to come. With the rise of extremist militias, tribal conflicts and a fractured political system, Libya may see the nation formally splinter into various regions and territories. This has already happened between the Eastern region of Benghazi and the official capital of Tripoli. But 2016 may see other regions such as Misrata, the southern border areas controlled by Tuaregs and other groups begin to take on a semi-permanent status. As a large oil-producing nation, Libya’s conflict will continue to fester. But interestingly enough, low prices and a drop in production to 500,000 per day (it was around 1.6 mpd in 2012) will likely mean multinational petroleum companies will not be interested in taking a larger role. This will effectively leave the resources squarely in the hands of local militias, extremists and tribal elements. Libya could possibly become the financial nexus of terrorist activities across the globe with a further descent into anarchy.

3 on the Bubble

Kenya

Kenya is a nation that represents great opportunity and great pitfalls. It is the largest receiver of foreign direct investment in East Africa, it enjoys a fairly educated population and has a relatively decent infrastructure by African standards. However, 2016 will see the nation face a number of challenges which, if not properly managed, can lead to instability. The first issue will be the Eurobond debt, which is expected to mature in 2016; there are very real concerns that Kenya will not be able to fully service the loan. This may lead to a further financial crisis and the Kenyan shilling losing value, as it has done in the past 14 months. From a purely economic standpoint, the Kenya economy will be viewed as a safe investment with a projected growth rate of 6-7%, as predicted by the IMF. However, the nation’s second and possibly bigger issue will be the judgment on the International Criminal Court case against the Deputy President, William Ruto. If convicted — and there is a good chance this will happen — it will cause a major fracture in the ruling party’s coalition and can quite possibly lead to ethnic conflict. With politicians already preparing for the 2017 election, 2016 may signal a great rise or great fall for Kenya. One final point to look out for in Kenya is the economic slowdown in China, which is heavily investing in several infrastructure projects in Kenya and the region. A slowdown in China will impact Kenya, but if the other two issues go in a negative direction, expect this to be met with a decline in foreign investment.

Nigeria

As a nation, Nigeria will experience tremendous obstacles and tremendous opportunities. The government receives up to 70% of its revenue from petroleum, and with declining prices and lack of investment during the oil boom, it remains to be seen how the central bank and investors react in 2016. Another issue in Nigeria will be how the nation’s security forces deal with Boko Haram as well as how the political system ensures that development and investment take place in the far northern areas to prevent general lawlessness from reoccuring. New president Muhammed Buhari has taken on a number of problems head-first and has vowed to defeat corruption and create a more diversified economy. However, opposition politicians (and even some allies) have voiced concern about the ability of Buhari and his cabinet to properly tackle the nation’s difficulties. Another interesting aspect of 2016 will be the return of more professionals from the Nigerian diaspora back to their homeland. This trend is being witnessed in various parts of Africa, but none will be more prominent than in Nigeria. With newfound innovation, Buhari’s fight against corruption and a nation that will be forced to establish a more diversified economy, Nigeria has the potential to maintain its position as one of top 3 economies.

Zimbabwe

2016 in Zimbabwe will be interesting to say the least. 2015 saw the nation peg its currency to the Chinese yuan, only for the Chinese economy to falter and their stock prices to plummet. In a country that has witnessed vast unemployment, political tension and outside pressure from Western governments, such measures may prove to be fatal. In Zimbabwe, all decisions begin and end with almost 92-year-old president Robert Mugabe. As the head of government, he has been lionized for his anti-Western and pro-African values sentiment, but he has also been vilified for cronyism, lack of economic development and outright despotism. In addition, 2016 will see Mugabe step down from his position as chairman of the African Union, which may signal a turn in support from other African leaders who declined to openly criticize him out of respect. The coming year will signal more pressure on Mugabe to make way for the next crop of leadership, but the challenge will be if he paves the way for his wife or simply leaves the door open for whomever is the most qualified to lead. A quiet exit from politics is hoped for but highly unlikely for a man who has rarely been quiet about anything.

Jamal Bradley is an American businessman from Philadelphia and currently based in Kenya.