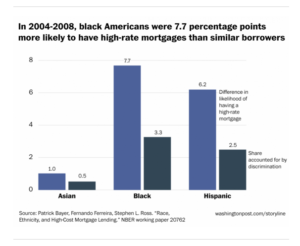

The scope of the problem of race-based mortgage discrimination against the Black community is well documented, and certainly an issue on which Atlanta Blackstar has reported in the past. But a working paper from the National Bureau of Economic Research has put meat on the proverbial bones and spelled out the extent of the problem with rich and wide-ranging data.

As had been reported by Jeff Guo in the Washington Post, a study compiled by Patrick Bayer of Duke University, Fernando Ferreira of the University of Pennsylvania and Stephen Ross of the University of Connecticut, examined federal mortgage data, public housing records and data from a credit agency. What they found was that between 2004 and 2008, Blacks were 7.7 percentage points more likely to have a high-interest mortgage than whites in the same financial condition, with a 54 percent increased risk of being charged with high interest. For the purposes of the study, high interest is defined as 3 percentage points higher. The results mirror those of previous studies, but in more detail.

People of color tend to have lower credit scores and more irregular credit history, which you can chalk up to the realities of living in a society rife with institutional racism and economic inequality. Some observers even attempted to blame Blacks and Latinos for causing the Great Recession due to banks taking a chance on these homebuyers with risky mortgages. That argument was debunked, and people of color were the largest victims of America’s economic meltdown, due to the predatory subprime mortgages they were given, amounting to historic losses in Black wealth in this country.

What is even more revealing about the study is not only the disparate treatment, but the method and source of the economic discrimination, which points to the insidiousness of institutional racism. These Black homebuyers were not necessarily treated differently than their white counterparts when they went to the bank. Rather, Blacks were steered toward different lenders altogether.

“A huge amount of the differences in high-cost loans is not whites and blacks going to the same lender and blacks being given a much higher rate,” Ross told the Washington Post. “Rather it’s the fact that there are big differences in the lenders that blacks and Hispanics are doing business with.”

Previous studies have shown that racial discrimination still plays a large role in the mortgage lending market, with a Black-sounding name effectively lowering one’s credit score by 71 points — a material impact on the financial well-being of Black people. Further, a study of the Baltimore housing market found that banks simply do not give mortgages to Black people. Although Blacks outnumber whites in that city 2-to-1, whites were given twice as many mortgages as African-Americans. In the end, the most significant factor in determining whether a loan was granted was not income, but the color of the people living in that neighborhood.