American financial institutions have a poor record when it comes to treating people of color fairly. Major banks such as Bank of America, Wells Fargo and JPMorgan have been caught offering minority customers higher interest rates than white customers, or steering them into high-risk loans. The Atlanta Blackstar also reported that Fifth Third Bank paid a settlement for charging Black and Latino customers higher interest rates on auto loans. However, the government is using a new tool to detect discrimination in auto loans.

According to Quartz, the government is using an algorithm called Bayesian Improved Surname Geocoding (BISG) to discover minority customers who have been discriminated against by Ally Financial Inc. The Wall Street Journal reported that Ally Financial, formerly known as GMAC, is a spinoff of General Motors.

Quartz reported that a 2013 investigation by the Consumer Financial Protection Bureau (CFPB) and the Justice Department discovered dealers affiliated with Ally had overcharged about 235,000 minority customers. The lenders used a trick called “dealer reserve,” which allowed them to add an extra fee on the loan for setting it up. Minority borrowers were charged an extra $300.

The government has used BISG to pay $80 million to people it believes were overcharged on their car loans. The reimbursement comes from a government settlement with Ally, who admitted no wrongdoing.

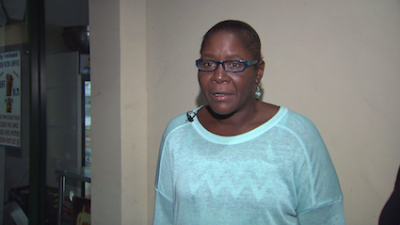

According to The Wall Street Journal, New York resident Erika Glemaud is one of the Black customers who received a letter from the CFPB saying she had been overcharged on a loan she took out in 2012.

“I was going to toss it because I thought it was junk mail,” Glemaud said. “It was a little bit upsetting to read that it was going on.”

Created in 2009, BISG uses public information available on surnames and geographic location to predict someone’s race. The government has also used the program to predict demographics on health care services and mortgage applicants. According to a test carried out by Quartz, BISG is about 70 percent accurate. But it’s not perfect, and as a result several white customers have received reimbursement checks.

The Wall Street Journal predicted the Ally case will set a precedent in how millions of dollars paid to the government by other auto dealers will be reimbursed. American Honda Finance Corp. and Fifth Third Bancorp have both paid settlements to the government for overcharging minority customers. Honda settled with the government for $25 million, while Fifth Third Bancorp paid the government $18 million. Both companies denied wrongdoing.