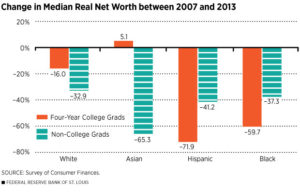

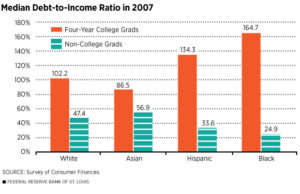

The study found that typical white and Asian families with a four-year college education fared better than families with less education, weathered the most recent recession and accumulated more wealth. In contrast, Black and Hispanic families headed by someone with a college degree generally performed much worse than their less educated counterparts. This was the case for the period between 2007 and 2013, as well as the two decade span ranging from the Clinton-era boom years to 2013.

According to the report, there are a number of reasons to suggest why Blacks and Hispanics have not kept their heads above water in both the short- and long-term economic landscapes.

“Job-market difficulties specific to Hispanic and black college graduates probably played a role, especially over the longer term,” the report said.

Duke public policy professor William Darity says he didn’t find these new figures all that shocking. He says, though, he’s not anti-education, he simply understands the its limitations.

“It is not the avenue to close the racial wealth gap,” the Duke public policy professor told NPR.

According to Darity, researchers have known for years that Blacks and Hispanics lag in terms of wealth generation and transfer. “And if one racial group has a much greater capacity to transfer resources to the next generation, then that’s what is the fundamental source of the kinds of disparities that we observe with respect to wealth,” he added.

The report also concluded that “Financial decision-making appears even more important in explaining large wealth declines among Hispanic and black college-educated families during the Great Recession and its aftermath.” Specifically, as Marketplace notes, many Black and Hispanic families assume a greater debt burden in order to achieve a middle-class lifestyle. Yet in hard times, that debt becomes a more burdensome.

Emmons surmised that educated Blacks and Hispanics looked good on paper, and were prime targets for bad loans, helping to tank the economy.

“So we think that probably really increased the sensitivity of many, many black and Hispanic families to a big housing downturn. And that would be very consistent, then, with these enormous losses of wealth,” Emmons added.

The St. Louis Fed report provides the data to bolster what some in the Black community have realized for quite some time. As Black people observe the 128th birthday of Marcus Garvey (August 17), we are reminded of the epic debate that the Black nationalist leader had with W.E.B. Du Bois, who argued that that education will solve all of Black people’s problems.

“The Negro race, like all races, is going to be saved by its exceptional men,” Du Bois argued. “The problem of education, then, among Negroes must first of all deal with the Talented Tenth; it is the problem of developing the Best of this race that they may guide the Mass away from the contamination and death of the Worst, in their own and other races. I insist that the object of all true education is not to make men carpenters, it is to make carpenters men.”

Meanwhile, Garvey understood that it was necessary to create economic solutions for Black people in order to build wealth in the community. His businesses employed thousands, and Black people were buying from Black-owned businesses and circulating the wealth in the community. Garvey was an advocate of learning, and through his Universal Negro Improvement Association he sought educational, industrial, social and political advancement of Black people.

“You must never stop learning. The world’s greatest men and women were people who educated themselves outside of the university with all the knowledge that the university gives, as you have the opportunity of doing the same thing the university student does — read and study,” Garvey taught. “Education is the medium by which a people are prepared for the creation of their own particular civilization, and the advancement and glory of their own race.”

However, Garvey and his supporters knew what the Fed study has demonstrated years later, which is that education will not solve racial inequality and institutional racism.

“Our critics say that the race problem will be solved through higher education, through better education, then Black and white will come together. That day will never happen until Africa is redeemed,” Garvey said. “Because if those who, like W.E.B. Du Bois, believe that the race problem will be solved in America through higher education, they will walk between now and eternity and never see the problem solved.”

Still, education is important, and the latest data should not lead one to conclude otherwise. However, the type of education one receives is a different story.

“Having had the wrong kind of education, the Negro has become his own greatest enemy,” Garvey warned.

But when it comes to building wealth, bridging the racial wealth gap and passing that wealth across generations, education provides no magic wand.