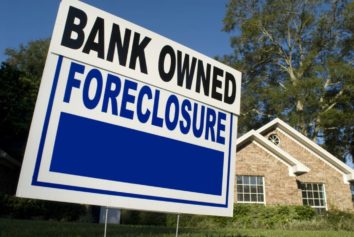

After increasing pressure from Congress, the White House, regulators and the public, Bank of America will begin the process this week of renegotiating up to 200,000 mortgages for customers who have fallen behind and whose homes have severely dropped in value.

Some customers could see as much as $150,000 chopped off their mortgage.

The bank is scheduled to begin sending out letters to these homeowners this week and has set aside $11 billion to handle the renegotiations, based on a settlement Bank of America reached with the government as part of a $25 billion agreement with the five largest banks.

Bank of America officials have cautioned that if homeowners throw out the letters—which will come via certified mail with the word “Important” in the top corner—they will not be eligible for the offer. Because homeowners receive so many specious offers in the mail from companies offering to renegotiate their mortgages, officials are fearful that many homeowners will not believe the Bank of America offer and will toss it.

There are approximately 5.59 million loans acoss the country that are either delinquent or in the foreclosure process, according to Lender Processing Services. Of those, about a million are serviced by Bank of America. The banks have been forced to come to a settlement with the government when it was revealed that millions of mortgages had been fraudulently or improperly processed during the housing bubble.