In 1940 less than two percent of African-Americans graduated from college. By 2016 that number had risen to nearly 30 percent. That increase should be a sign of success however the financial challenges faced by Black graduates has meant that a college education is not what it used to be.

Although Black students enroll in college in numbers roughly equal to other ethnic groups, Black students are less likely to complete their degrees than their white counterparts. Moreover, over the past twenty years, college costs have skyrocketed. While these tuition increases affect students of all races, loan interest has a greater impact on Black students because as a group they are more likely to borrow for college. As college costs rise and pay increases have become stagnant, the question must be asked: Is college worth it for African-American students?

The Many Costs of College

The biggest factor in the decision to go to college is the cost. While there are many ways to finance a college education, Black students may find themselves at a disadvantage in many of these routes.

Black students looking to finance their degrees through merit-based awards (e.g., scholarships based on academic achievement) are at a disadvantage. According to a 2011 report, over 75 percent of merit-based awards went to white students, with the remaining 25 percent split between nonwhite racial groups. The disparity stems, in part, from the fact that some scholarships target activities (e.g., water polo, equestrian sports) or geographic areas with low numbers of African-Americans. Moreover, Dr. Jackie Thomas, the Chief Strategist at Lone Star College-Tomball in The Woodlands, Texas, notes that many of the African-American students he advises talk themselves out of applying for scholarships because they do not think they are are going to receive over other applicants. Dr. Thomas also notes that some students, particularly first-generation students, may think that the application process is too difficult.

Some students turn to their parents for financial help. However, Black parents are generally less able to provide financial assistance. A Sallie Mae report found that Black parents are just as likely as parents of other races to save for college. However, the same report found that Black parents generally save about $5000 less for college than white parents.

This means that Black students turn to borrowing more than their white counterparts. A report from the Center for American Progress found that 64 percent of white students graduate with debt, while 81 percent of Black students will carry debt across the stage along with their diplomas. Not only are Black students more likely to borrow, they generally borrow more. According to the Center for American Progress reports states that 27 percent of Black students borrowed more than $30,500. Only 16 percent of white students borrowed as much.

Another reason for the increased amount of borrowing for Black students is where students tend to enroll. Black students are more likely than students of other races to enroll in for-profit colleges in a search for promised marketable skills. For-profit schools generally charge more to attend than public or private institutions. Because Black students are more likely to enroll at institutions with higher costs, they may borrow more.

Yet another factor that increases the cost of college for Black students is that they enter college with less academic preparation than other students based on poorly resourced secondary schooling. According to Kevin McClain, Professional Academic Adviser at Xavier University of Louisiana, “Being unprepared could potentially cost you thousands of dollars in tuition.” Mr. McClain notes that because institutions usually determine where students are placed based on standardized test scores, students with low scores may be placed in remedial courses. As such, it will take them longer to enroll in core courses that satisfy graduation requirements. He notes, “This process could take a semester, a year, or a few years, therefore prolonging the amount of time and money the student spends in college.”

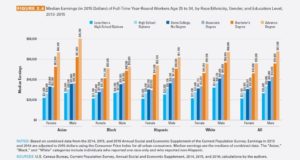

Beyond cost, there is the issue of employment after graduation. Several studies have shown that having a degree does not guarantee financial success for African-Americans. Black college graduates are nearly twice as likely as whites to be unemployed after college. Moreover, even when employed, Black college graduates earn less than their white peers. A student that is not employed is not able to repay her loans. However, during the period of unemployment, loans may continue to accrue interest. Moreover, depressed wages mean that loan payments will take a higher percentage of Black graduates’ income.

The Benefits of College – The Good News

All this data can make one think that college may not give Black youth the financial freedom that society promises, that the pitfalls of financial debt offset any advantage a degree could bring. While the cost of college is high and the benefits are not guaranteed, there are still many reasons to seek a college education.

Although Black graduates don’t receive the financial bounce as white graduates, based on where they start out in life, another comparison may be just as important which is comparing Black graduates to Black non-graduates. A 2016 report by The College Board notes that the average African-American male with just a high school diploma earns approximately $25,000 per year. However, the same report notes that an African-American male with a college degree earns almost $49,000.

Source: The College Board, Education Pays 2016

Moreover, while studies show that college education does not close the racial wealth gap between Blacks and whites, other research shows that education does close racial earning gaps somewhat. In the end, perhaps the question isn’t whether college is a good choice, but how to make good choices about college. Dr. Thomas and Mr. McClain have some suggestions.

First, parents must make sure that their child is ready for college. Because young adults mature at different rates, some students simply may not be ready to attend a four-year college immediately after high school. However, both experts agree that students do not need to begin at a four-year institution to be successful in the long term. Dr. Thomas notes that while many students feel that there is a stigma around community colleges, they should let go of the notion that community colleges are “less than,” because most community colleges have excellent faculties and facilities. Both experts were clear that community college can be a good place for students to learn about the expectations of college without incurring the level of debt that they would at a four-year college.

Mr. McClain notes that there is another option available: vocational schools. He states, “Trade schools can provide students of color the skills necessary to enter the workforce either through employment or entrepreneurship. Similar to four-year institutions, trade skills can provide students with the tools necessary for economic freedom.”

Once the family decides that a student is ready to attend a four-year college, more steps should be taken. Both experts agree that parents must educate themselves about the scholarships that are available for students, and then educate themselves on how to apply for them. Unlike loans, scholarships do not need to be repaid, so this is an important step.

Finally, students should choose a major that reflects their passion. Mr. McClain notes that he sees many students that have chosen a major because of their parents’ preferences or what they think the earning potential of that major will be. However, he says students should choose a major based on their passion. Failure to do so may result in years spent repeating courses which, of course, increases the overall cost of that student’s education.

Black students need every advantage possible in the workplace. A college degree can be a valuable asset. Black parents should begin preparing themselves and their children for college or vocational school while their children are small. The more effort we put into planning for college, the more likely it will be that the degree earned will be valuable in every sense of the word.