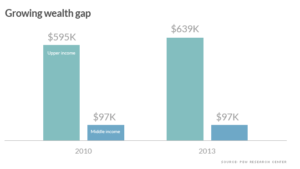

The gap between the total wealth for middle class Americans and wealthy ones has revealed a troubling trend in the U.S.

The median household net worth for middle class Americans remains stagnant at $96,500, according to a new report from the Pew Research Center.

Wealthy Americans saw their wealth grow from $595,300 last year to $639,400 this year.

To put things in perspective, wealthy Americans now have a median net worth that is close to seven times greater than that of the middle class and a shocking 69 times greater than that of lower-income Americans.

Ever since the nation began its slow climb to recovery since the Great Recession in 2007, the middle class has failed to bounce back. With the rising cost of living combined with middle-class incomes not budging, these Americans might not see any substantial growth in their wealth for quite some time.

The source of these Americans’ wealth is also playing a major part in how fast they have recovered since the recession.

While wealthy Americans are getting a substantial amount of their wealth from investments in the stock market, according to CNN Money, middle-income Americans have more money tied up in the housing market.

The stock market has been recovering quickly but the housing market hasn’t seen the same success.

Prior to the housing market crash in 2007, however, the middle-class was thriving and its median wealth jumped to nearly $160,000.

In 2013, the median household income for white families was more than seven times greater than that of Black households.

The housing market crash was yet another setback for the Black community.

Reports indicate that home ownership is 28 percent higher for white people—a statistic that is not only the result of a growing wealth gap but also of the long-term impact from racist housing policies enacted by the Federal Housing Association (FHA) years ago.

More recently, big banks subjected people of color to discriminatory practices that pushed them far behind when it came to wealth and home ownership.

Wells Fargo, Bank of America and other major banks charged people of color higher rates and fees for home loans and were even guilty of pushing them into subprime mortgages.

These practices, along with a number of other racially discriminatory policies, have left the Black community struggling to increase their own wealth, which ultimately means the middle-class’s median wealth is continuing to suffer while the rich in America grow richer.