In the two decades since Nielsen Soundscan started to keep track of U.S. album sales in 1991, the company has seen the industry fold in half, digital sales catch up to physical, and vinyl mount a resurgence. But until last week, they’d never seen old records outsell new ones.

The first six months of the year saw sales of 76.6 million catalog records — industry-speak for albums released more than 18 months ago — compared to 73.9 million current albums. “That’s a combination of two things: not having the big blockbuster new releases in the first half, and having very, very strong catalog,” says Nielsen analyst David Bakula, who points out that these numbers resulted even though Adele’s 21 — still considered current — has sold a million more copies in 2012 than it had at this point in 2011.

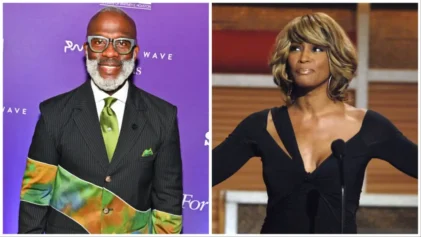

The top-selling catalog records of the year so far include Guns N’ Roses’ Greatest Hits and four records by Whitney Houston, whose canon got a boost after her death in February. Bakula says the biggest reason catalog has been so strong is that record labels and retailers continue to drop the price of older albums, often to as low as $5.99 or $7.99. Those prices, sometimes half of what they once were, are bringing in new customers. “I really, truly do believe that there probably is a consumer that is buying music here that wasn’t buying music in the past,” he says.

Mike Batt, owner of Seattle’s Silver Platters chain, says the steady flow of catalog sales has helped make 2012 a better year than 2011. “I think a lot of [music retailers] would say they feel better this year about things than they did last year,” he says.

Though album sales dropped 3.2 percent in the first half of the year as compared to the first half of 2011 — with 150.5 million albums sold — digital album sales (current and catalog combined) grew 13.8 percent and physical albums stayed basically flat, shedding just 0.6 percent. The slide in sales is attributable to a slump in purchases of new albums, which are also more expensive. Catalog CDs and most digital albums stay close to the $7.99-$10.99 range, while new CDs are mostly in the $13-$18 range.

So is the message here that consumers would be willing to buy more new CDs if the price dropped? Dave Dederer, co-founder of the Presidents of the United States of America and a digital-music entrepreneur now working for Hewlett-Packard, doesn’t think so. He feels listeners willing to pay $7.99 for new records–as opposed to stealing them online and paying nothing, which is by far the most popular way of acquiring music–are equally willing to pay $14.

One major-label executive, who asked not to be named, says labels have long experimented with variable pricing, depending on the release. “There’s no standard pricing, if you will,” the exec says. “It really depends on the dynamic of the project and the consumer profile, and how we can best fit the consumer profile.”

Jason Hughes, owner of Ballard’s Sonic Boom, says $12.99 should be the ceiling for new records, but dropping them any lower is a slippery slope. “As you lower the price of the CD, you’re lowering the value of someone’s art,” Hughes says. “At what point do you say ‘We’re going to sell them for $9.99 and [artists are] not going to be able to make a living off their music, or they’re going to have to tour 11 and a half months a year’?”

Source: LA Weekly