According to the Economic Policy Institute, “The substantial progress in educational attainment of African Americans has been accompanied by significant absolute improvement in wages, incomes, wealth, and health since 1968. But black workers still make only 82.5 cents on every dollar earned by white workers, African Americans are 2.5 times as likely to be in poverty as whites, and the median white family has almost 10 times as much wealth as the median black family.”

When it comes to home ownership — a well proven method of attaining and passing down generational wealth — the news is even more dire. With EPI also finding that in terms of family wealth, “One of the most important forms of wealth for working and middle-class families is home equity. Yet, the share of black households that owned their own home remained virtually unchanged between 1968 (41.1 percent) and today (41.2 percent). Over the same period, homeownership for white households increased 5.2 percentage points to 71.1 percent, about 30 percentage points higher than the ownership rate for black households.”

African-American families have also faced numerous legal hurdles, including policies created by the Home Owners Loan Corporation and later institutionalized by the U.S. Housing Act. Established during the Franklin Delano Roosevelt administration, for years federal housing agencies were allowed to determine which areas were “fit” to receive home loans, often resulting in low-income and minority neighborhoods being denied such access.

After years of largely ignoring Black and Hispanic families, the 2008 housing crisis exposed a startling new trend, as financial institutions began targeting minorities in order to deliver high-interest subprime loans and mortgages, an effort that decimated strides gained in the years following the passage of the Fair Housing Act.

As CityLab explained in 2013, “In 2006, at the height of the boom, black and Hispanic families making more than $200,000 a year were more likely on average to be given a subprime loan than a white family making less than $30,000 a year.”

While measures like the Dodd-Frank Wall Street Reform and Consumer Protection Act were implemented in an effort to curb such practices, new legislation currently making its rounds through Congress may make it more difficult to maintain banking transparency, thanks in part to a bill that would ease regulations on smaller banks under the guise of making them more competitive against larger institutions.

Sponsored by Republican Senator Mike Crapo of Idaho, the intricate “Economic Growth, Regulatory Relief, and Consumer Protection Act” would lessen regulations by allowing smaller banks to once again engage in more risky investments through a series of exemptions.

Although the bill, which found some bipartisan support in passing the Senate 67-31 on March 14, critics argue that easing such protections could disproportionately hurt Black communities by once again allowing banks to target them with reduced oversight on the types of loans and mortgages granted.

In perhaps a more direct threat to minority and low-income borrowers, the Senate bill would allow many banks to report less data on who they lend to and at what rates. Oversight agencies use this data to uncover patterns of discrimination. The Consumer Financial Protection Bureau — another agency the Trump administration is hamstringing — has reported that as many four out of five banks and credit unions would have fewer reporting requirements if this bill is signed into law.

As previously proven via various lawsuits against banks like Bank of America and Wells Fargo, left to their own devices, various financial institutes have willingly played a role in purposely denying minorities home loans and mortgages, with the Los Angeles Times finding as far back as 1992 that Wells Fargo had purposely rejected 67 percent of Black applicants.

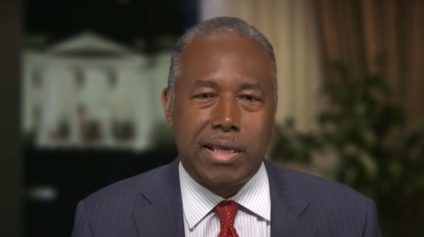

Meanwhile, agencies meant to guard against such discrimination, like the Department of Housing and Urban Development, have recently come under fire for failure to provide such protections. Under the leadership of Ben Carson, the agency has found itself under fire after it sought to remove language meant to protect consumers. The Huffington Post reported that words like “free from discrimination” will be scrubbed from HUD’s mission statement entirely.

As Diane Yentel, the leader of the National Low Income Housing Coalition recently wrote, “It’s especially appalling, as we near the 50th anniversary of the Fair Housing Act, that Secretary Carson would signal this step away from Dr. King’s legacy.”

She continued, “Housing policy created the segregated communities that exist today — and federal, state and local governments have an obligation to reverse these trends by furthering fair housing.”

Now that Sen. Crapo’s bill is passed, 85 percent of banks would no longer be required to report detailed information regarding their lending practices, leaving no additional protections against the troubling trend that housing discrimination is still alive and well.

Speaking with the Washington Post, Catherine Lhamon, chairwoman of the U.S. Commission Chair on Civil Rights explained “The data operates as a canary in the coal mine, functioning as a check on banks’ practices. The loss of that sunlight allows discrimination to proliferate undetected.”

The House, without a single Democratic vote, passed its own version of Dodd-Frank reform last year. The two versions of the legislation must be merged into a compromise bill before it can be sent to the White House for President Donald Trump’s signature, an uncertain process that could take months to achieve.